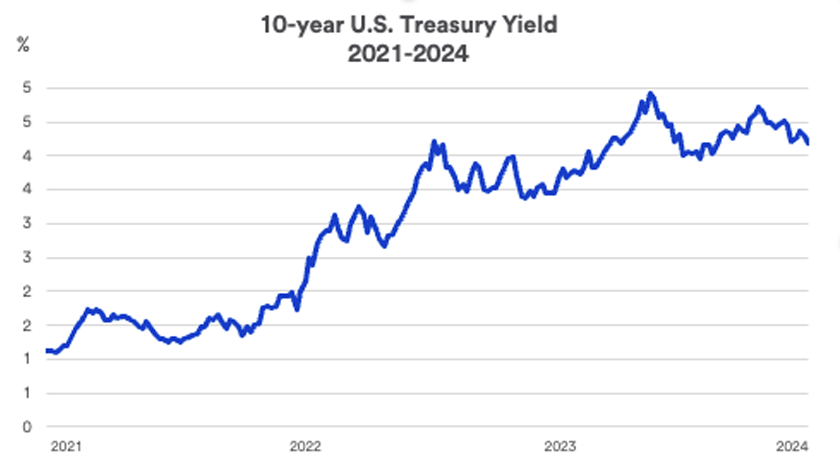

“Investors have poured money into cash vehicles offering 5% yields, but they need to be cautious,” says Haworth. “Once the Fed decides to begin cutting interest rates, yields on short-term vehicles will decline.” Haworth recommends income-oriented investors begin to lock in current high rates on longer-term bonds.

Interest rates and the economy drive markets

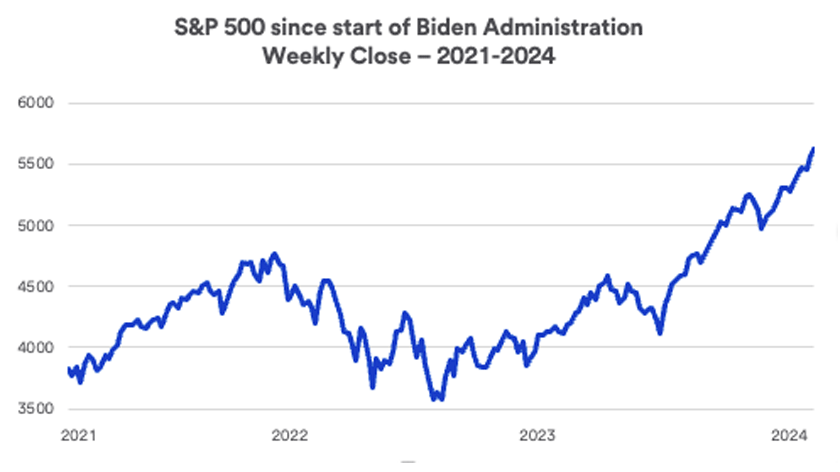

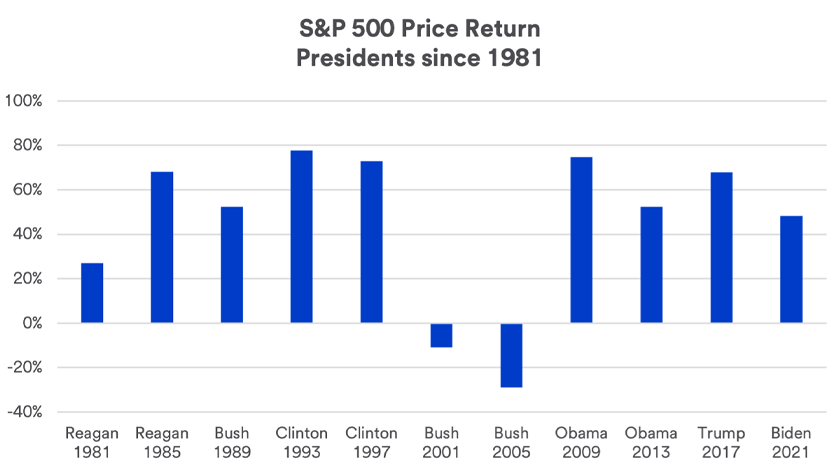

Although the political and policymaking environment draws headlines, particularly in an election year they have not been major capital market drivers. Investors appear more focused on Fed policy, economic data and corporate earnings.

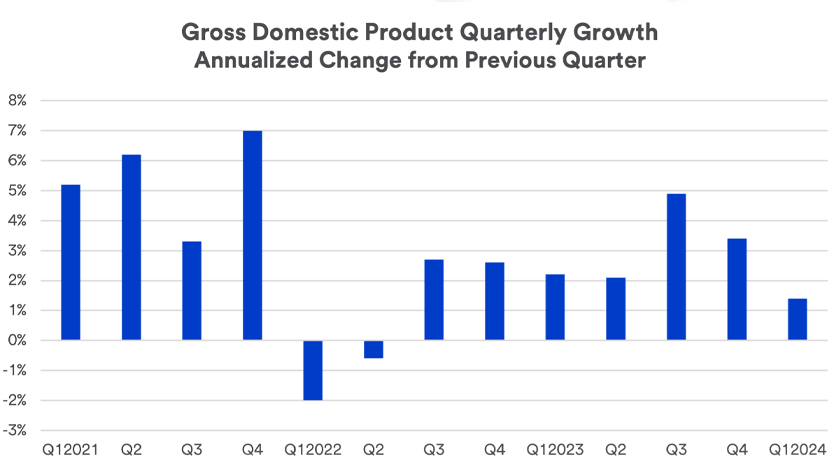

“We had much better economic growth than many expected in 2023, and that may continue in 2024, depending in part on how well the labor market holds up,” says Haworth. Markets appear to be increasingly focused on when and how much the Fed will begin lowering interest rates, with the expectation that such a move could improve the investment environment. The state of the economy will likely generate increasing interest as the election approaches.

A changing legislative landscape

President Biden, backed by a Democratic-controlled Congress, successfully passed a number of legislative initiatives in his first two years in office. The midterm elections in 2022 changed the legislative landscape. While Democrats maintained narrow control of the Senate, Republicans won a slim majority in the House. “With power split between two parties, legislative initiatives have been limited,” says Kevin McMillan, head of state and federal government relations at U.S. Bank. However, bi-partisan support in April 2024 led to approval of a funding package to, among other things, support Ukraine's military defense against Russia and to aid Israel as well in its conflict with Hamas. However, it took months to gain final passage of these and related measures.

The political power divide led to contentious negotiations that resulted in last minute approval of an agreement to allow the government to issue additional debt, and to an overdue approval of the 2024 fiscal-year budget. However, the two parties did manage to reach agreement in both instances.

Haworth is skeptical that continued partisan differences in Washington will have a major impact on markets. “The market is currently at a wait-and-see point about the 2024 election, seeking more clarity about the candidates, possible election outcomes and the potential economic and market ramifications,” says Haworth.

Positioning portfolios today

It’s important to note that several factors contribute to market performance, and it’s not strictly a reflection of the individuals who wield power in Washington or the outcome of any given election. Investors are best served by maintaining a broader perspective.

Depending on one’s goals and time horizon, today’s investor might consider:

- A modest overweight position in equities and real assets, while reducing fixed income positions, to take advantage of ongoing economic growth and the impact of higher inflation.

- Equity investors may benefit from putting money to work in an equal-weight S&P 500 Index fund that allocates equally across the index, rather than concentrating a significant portion on the largest funds in the index, which have already experienced significant gains.

- Within fixed income portfolios, tax-aware investors may wish to consider a modest allocation to high-yield municipal bonds and longer duration bonds.

- For taxable fixed income portfolios, consider ways to enhance income with positions in non-agency residential mortgage-backed securities and, to address inflation, Treasury Inflation-Protected Securities (TIPS).

Regardless of how events play out during the 2024 election cycle, a sound investment strategy is to focus on a properly diversified portfolio that is attuned to your goals, time horizon and risk appetite.

Have questions about the economy, capital markets or your finances? Your U.S. Bank Wealth Management team is here to help.