“It’s important as a signal for the economy overall that we see market leadership broaden beyond technology names,” notes Haworth. “However, it doesn’t mean that investors are ready to lower expectations for AI companies, which would primarily benefit the technology sector.”

Given their significant recent price gains, do tech stocks remain an attractive value for investors? How will conditions in the underlying economy affect the environment for these stocks?

An evolving tech sector

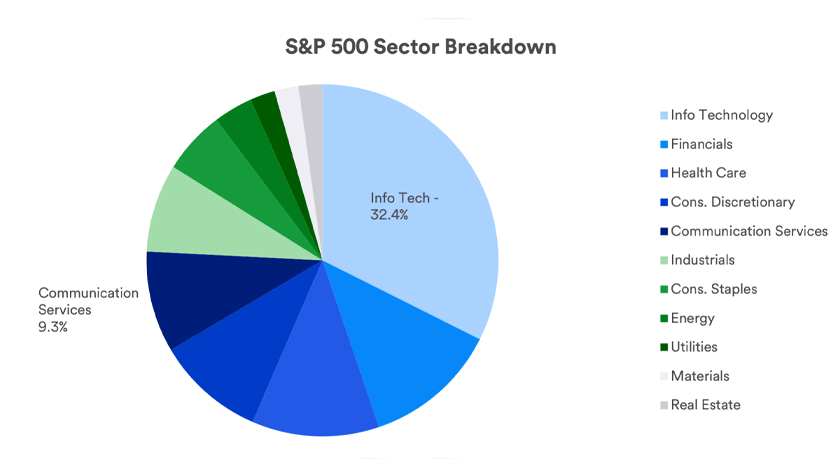

Technology stocks are prominent among what are considered the “mega-cap” stocks of the S&P 500. six of the top seven stocks in the index (Microsoft, Nvidia, Apple, Alphabet (2 classes), Meta Platforms) are in the information technology and communication services sectors. Those six listings alone represent more than one-fourth of the market capitalization of the S&P 500.3

But these prominent stocks only scratch the surface. Technology stocks represent a wide range of companies that cut across a variety of sectors within the broader stock market. New technologies and companies continually emerge.

Nvidia, a 30-year-old company that is heavily involved in the artificial intelligence arena, is a prime example of how the surge of excitement over the potential of AI can fuel investor enthusiasm. Over the course of 2023, Nvidia stock rose 239%, and has gained another 138% in value year-to-date through July 19, 2024.4

“Chip companies that are growing profits through strong order volume are, to this point, the biggest beneficiaries of the AI push,” says Haworth. “Nvidia’s fast-rising stock values can seem unrealistic, but they are backing them up with very positive earnings results and favorable forecasts for future earnings.” Haworth says AI and cloud computing account for a significant portion of today’s corporate spending, as companies seek to enhance productivity and boost their bottom lines. “Equity markets are paying close attention to this trend, and companies that provide AI and cloud computing solutions are generating significant profits.”

Haworth says productivity growth is a key measure to watch in determining the effectiveness of AI implementation. Productivity measures the level of inputs required, including labor, to generate a certain amount of output. “In general, U.S. productivity trended lower after World War II, but since the onset of COVID-19 in 2020, we’ve seen some productivity improvement,” says Haworth. “If AI helps boost productivity, that will support not only corporate earnings and current rising stock valuations, but individual prosperity as well.”

How long can the tech stock surge persist?

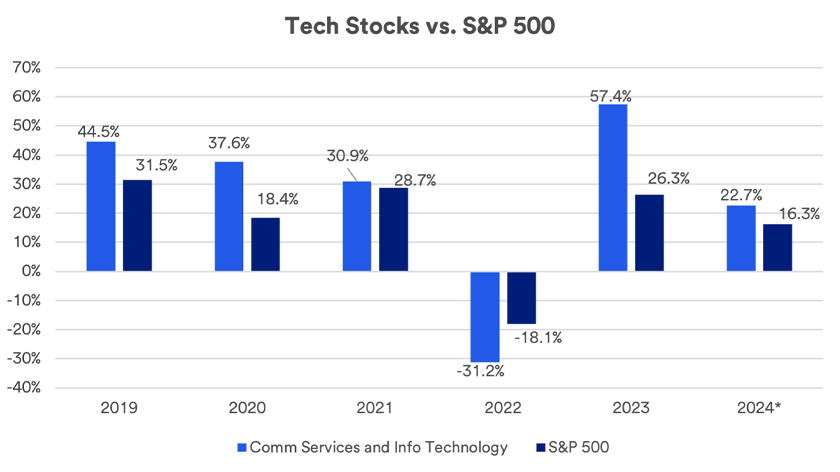

Over four of the previous five years, technology stocks have outpaced the broader stock market. 2022 was a notable exception. So far in 2024, technology stocks again lead the market. Tech stocks enjoyed a solid bump in May and June, but in July, the market began to broaden out to the benefit of other sectors. The Communication Services and Information Technology sectors declined more than 6% between July 10 and July 19 as investors rotated out and into mid-caps. However, Communication Services and Information Technology continue to outpace the broader S&P 500 year-to-date.1