Notably, based on year-to-date through August 5, utilities stocks overtook information technology, and only slightly trailed communications services stocks.

Key stock market drivers for the remainder of the year

What are the keys to a sustained bull market? The primary considerations that deserve attention include:

- Inflation and labor market trends and their impact on future Fed policy moves. “The attention of the Fed, which was previously centered on tempering inflation, is now focused as well on the labor market,” says Haworth. The Fed is expected to initiate rate cuts at its next meeting on September 17-18.

- Consumer and business spending. “Consumers’ willingness to maintain reasonable spending growth has been an economic linchpin,” says Haworth. The labor market’s strength, including solid wage growth, contributed to that factor. The U.S. economy grew at an annualized rate of 2.8% in the second quarter, double its first quarter growth rate.6 “The economy may be growing at a slower pace than before, but not at a pace yet where we consider it to be a recession risk,” says Haworth.

- Corporate earnings and stock valuations. Second quarter earnings, as reported to date, are growing at an 11% pace compared to 2nd quarter 2023 earnings. “Despite their challenges since late June, technology stocks are still the biggest driver of corporate earnings,” says Haworth. The path of earnings over the course of 2024 may play a big part in determining the risk of a further market correction.

External risks must also be considered. Current issues include the impact of global tensions highlighted by the Israel-Hamas conflict and the Russia-Ukraine war. The heated lead-up to what appears likely to be a contentious presidential election may ultimately draw more investor attention.

Equities still offer opportunity

While the forward view for diversified portfolios remains constructive, recent market events may offer an opportunity to reassess your financial assets relative to goals. You want to ensure that your portfolio is aligned with your long-term objectives.

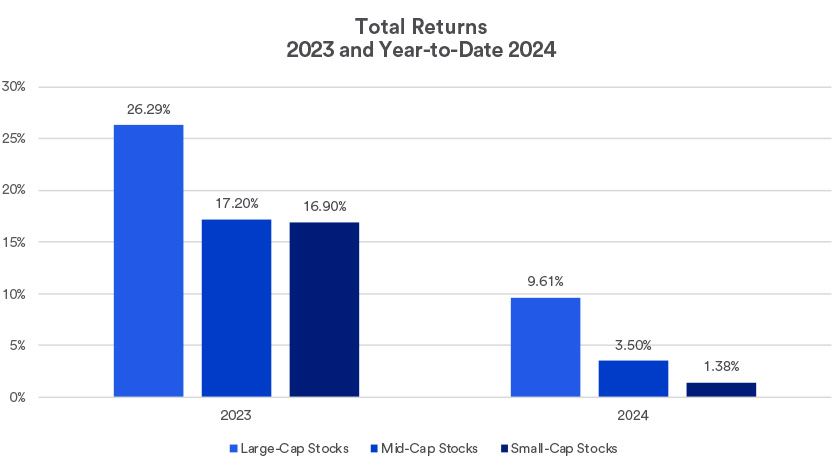

Haworth says investors may wish to consider diversifying with an equal-weighted S&P 500 exchange-traded fund. Such a fund puts less emphasis on the largest stocks in the Index compared to a traditional S&P 500 fund, seeking to capitalize on opportunities in what have been underperforming stocks in the index.

Haworth adds that “for those with money on the sidelines waiting for a bell to ring to get back into the market, the bell has rung.” He suggests investors “consider putting a portion of your portfolio to work in equities in a systematic way, such as dollar-cost averaging available cash over a series of months.”

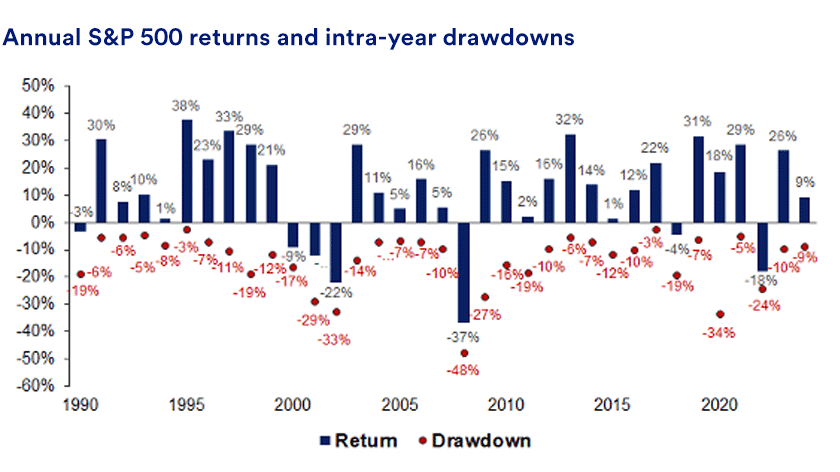

Freedman encourages investors to view markets with a long-term lens. “Timing the markets and trying to be precise on when to be in and when to be out is challenging,” says Freedman. “Markets will do things at the exact opposite time you expect them to.”

This is an important time to check in with a wealth planning professional to make sure you’re comfortable with your current investments and that your portfolio is structured in a manner consistent with your time horizon, risk appetite and long-term financial goals.

The S&P 500 Index consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. Diversification and asset allocation do not guarantee returns or protect against losses. The Russell MidCap Index provides investors with a benchmark for mid-sized companies. The index, which is distinct from the large-cap S&P 500, is designed to measure the performance of mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment. The Russell 2000 Index refers to a stock market index that measures the performance of the 2,000 smaller companies included in the Russell 3000 Index.