U.S. economy still growing

The underlying economic environment demonstrates continued strength, with Gross Domestic Product (GDP), the key measure of economic growth, expanding at an annualized 2.8% rate in 2024’s second quarter. That doubled the first quarter’s annualized growth rate of 1.4%, and even exceeded 2023’s 2.5% growth rate.5 “As we look forward from here, most of the data points to a still-expanding economy,” says Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management. “Early third quarter signs are generally positive as well, including retail sales data showing that the consumer remains resilient,” says Haworth.

“The economy’s held up reasonably well to this point because of the strong labor market, and consumers’ fairly strong financial position,” says Eric Freedman, chief investment officer for U.S. Bank Wealth Management. “Corporate profits are still intact, and corporate spending remains robust.” Freedman adds says there’s an expectation that economic growth will slow, but that isn’t catching the markets off guard.

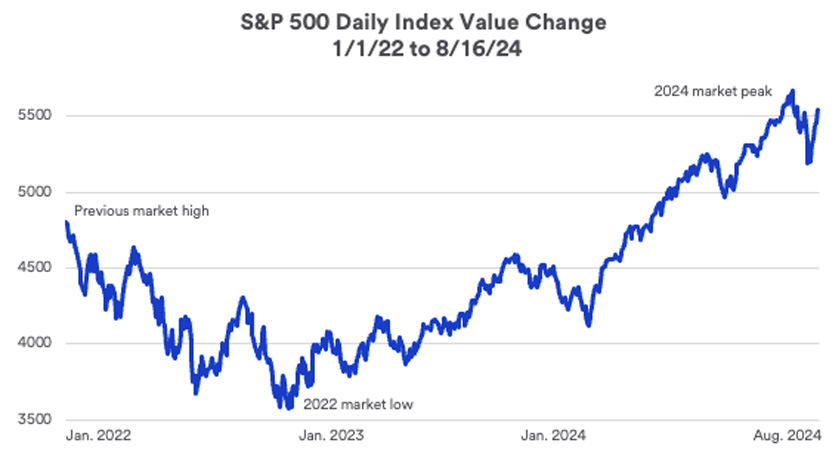

What’s driving the markets

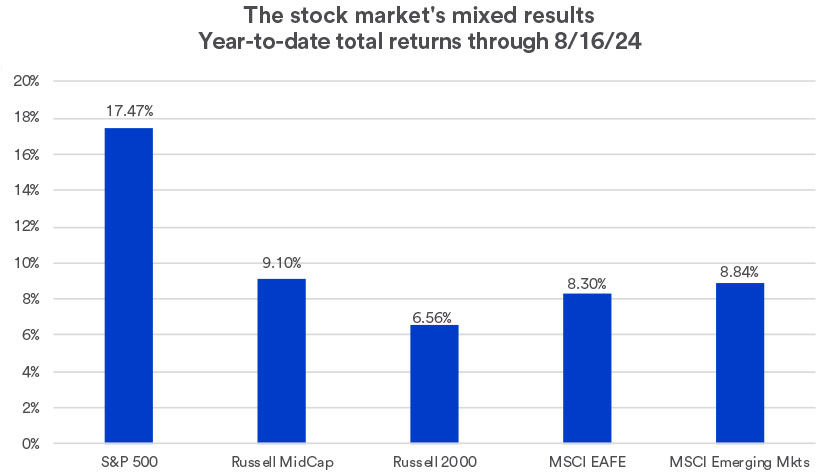

As was the case in 2023, much of the market’s strong 2024 performance can be attributed to technology-oriented stocks. Earlier in the year, leadership broadened out to other sectors, but by May investors were increasingly focused on companies positioned to benefit from recent and projected advances in artificial intelligence (AI). “We’re still in the camp of a ‘glass half full’ for investors,” says Freedman, “The bias for stocks at this point is higher, not lower.”

In the fixed income market, Haworth says prospects of pending Fed rate cuts may not have an immediate impact on longer-term bond yields. “For 10-year Treasuries and other longer-term debt, factors like future inflation and economic growth expectations will be more important than Fed rate cuts,” says Haworth. “Fixed income investors may want to consider other options outside of traditional Treasury and investment-grade corporate bonds.”

What to invest in right now

Haworth says given the degree of uncertainty in the market, some may want to look into dollar-cost averaging as a way to effectively invest in equities. “By making regular investments over a period of time, you aren’t anchored to an investment at a single price; you stretch your investment out at different price points over time,” says Haworth. “It also gets you going on an investment plan so you can start growing your wealth now.”

Assets that are set aside to meet funding needs in the next 18 months should capitalize on today’s elevated interest rate environment by utilizing higher-yielding savings accounts, CDs and money market mutual funds. However, Haworth notes that short-term savings yields are likely to decline as the Fed cuts interest rates.

“Be prepared to take what the capital markets offer given the current environment’s realities,” says Freedman. He advises that long-term investors consider positioning their portfolios with an above-neutral mix of equities, while reducing weightings in fixed income investments. Freedman adds, “It’s critical to have a financial plan that’s tied to the specific goals you hope to achieve.” With a plan in place, you can more readily identify investment strategies that align with your goals.

Based on your situation and goals, other portfolio strategies that can play a potentially contributory role in your portfolio include:

- An S&P 500 Equal Weight index fund or ETF, which allows equity investors to capitalize on U.S. economic strength that should result in improved earnings prospects for companies that have underperformed the market to date.

- Slightly longer-than-average durations in municipal bonds, including an allocation to high-yield municipal bonds for tax-aware investors.

- Non-taxable fixed income portfolio diversification into lower quality securities, such as residential mortgage securities not backed by a government agency. This should supplement allocations to U.S. Treasury securities.

- Reinsurance as a way for trust portfolios to capture differentiated cash flow with low correlation to other portfolio factors such as market or economic trends.

Discuss options with your wealth management professional and be sure to understand the risks associated with each of these investments. Determine whether any can help you more effectively diversify your portfolio.

Freedman adds it’s important to regularly review your plan with your wealth management professional. Determine whether there are opportunities to rebalance your portfolio in ways that more appropriately reflect your investment objectives, time horizon, risk appetite and the current market environment.

Have questions about the economy, markets or your finances? Your U.S. Bank Wealth Management team is here to help.