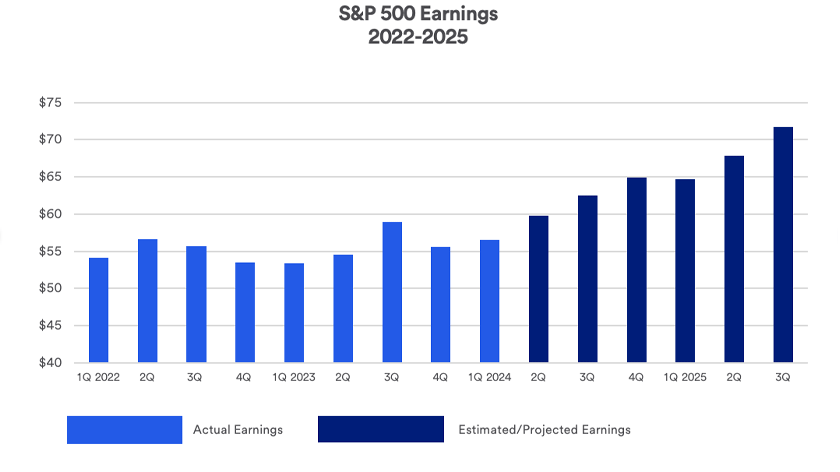

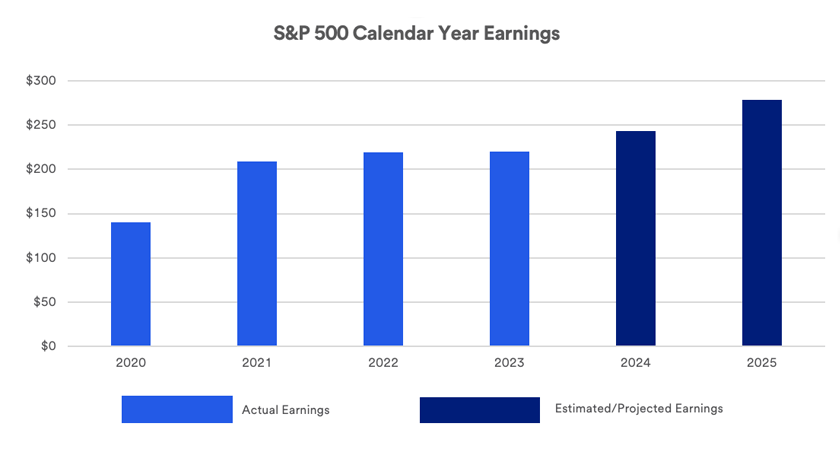

However, Haworth also notes that if a recession is avoided, investors may conclude earnings expectations were too pessimistic, and favorable earnings surprises could result. Often when that occurs, the stock market reacts positively.

Role of earnings in stock valuation

The publicly traded companies represented as stock holdings in your portfolio deliver quarterly financial statements that include a wide range of information. This includes a breakdown of sales (revenue) and expenses, the two key factors that determine earnings.

Earnings information is important because it provides a glimpse into the company’s business success in recent months. In many cases, companies provide “guidance” regarding their future earnings and growth prospects. This guidance serves as a preview of what may come based on trends companies experience in their businesses. While corporations often provide earnings guidance, it is not a requirement. According to FactSet, as of July 19, 2024, only 32 S&P 500 companies provided third quarter 2024 earnings guidance to date. Sixteen of those offered “negative” earnings guidance, a signal to investors that a company’s quarterly earnings for the quarter may be less than initially expected. The 16 other companies provided “positive” guidance, indicating they anticipate better-than-expected quarterly earnings results.1

Professional stock analysts often estimate, in advance, their own expectations for what companies will report each quarter. “Investors are very attuned to the forward-view of earnings, which reflects the stock market as a discounting mechanism,” says Haworth. In other words, stock prices are based less on a company’s past performance and more on expectations of future financial success. “Stock prices typically incorporate a consensus market belief about the future state of a company, including earnings, growth prospects, risks, pricing challenges and other factors,” says Haworth.

Factors in valuing a company’s stock

Earnings provide the basis of one of the major measures of a stock’s individual value. Investors often use a statistic known as the price-to-earnings (P/E) ratio to help assess how expensive a stock is relative to the rest of the market. In other words, it is the ratio of the current price of a stock compared to the company’s earnings. If a stock is trading at $30 per share and the company’s annual earnings are $2 per share, the P/E ratio is 15.

Haworth notes that P/E ratio is just one measure of a stock’s performance. “We look at a variety of valuation assessments, including sales growth and book value growth, which is essentially a way of estimating the liquidation value of a company.” Other factors would include a company’s cash flow and a stock’s dividend yield.

When trying to assess which of two stocks offer the best investment opportunity based on their P/E ratios, it’s not always an “apples-to-apples” comparison. “Determining fair value has a lot to do with the underlying growth rate of the industry in which the company competes,” says Haworth. In some cases, investors may be willing to bid up prices based not on current earnings, but on expectations of future profitability. “This tends to be the case, for example, with stocks that invest in new technology that may not have an immediate payoff but offer the potential of future strong earnings if they succeed,” says Haworth. “Other stocks may have lower P/E multiples, but those companies generate steadier earnings, so the payoff on the investment needs to happen in a more compressed timeframe.”

Other variables can be reflected in the earnings they report. “It’s worth reading beyond the headline numbers,” says Haworth. “Unique, one-time events may affect earnings, either positively or negatively.” For example, if a company’s earnings declined due to a one-time major expense, that shouldn’t necessarily reflect poorly on its outlook. Similarly, if a company reports a strong boost to earnings, for example, because it sold off one of its business units, which may not reliably indicate future strength.

How earnings are reflected on the broader stock market

As they do with individual stocks, analysts can place a P/E valuation on the broader market. As of June 30, 2024, the P/E ratio of the S&P 500 based on earnings in the prior 12 months was 24.79, while the P/E ratio based on projected earnings for the next 12 months is 21.1.3 Analysts may set different valuations on the market based on varied sets of projections.

With S&P 500 P/E ratios based on projected earnings exceeding 20 times earnings, Haworth says the market may, on the face of it, look expensive, “but we’re in a different state now. Interest rates are elevated and inflation has come down significantly, so higher market multiples (P/E valuations) may be justified.” Haworth notes that technology-related stocks make up more than one-third of the S&P 500’s valuation in today’s market. “These companies are generally expected to realize faster, long-term growth rates, so they are often valued at higher multiples than other types of stocks.” For example, at the end of June 2024, the P/E ratio for the S&P 500 Information Technology sector, based on projected earnings, was 30.0, compared to 21.1 for the broader S&P 500 Index.4

Preparing for the current environment

Haworth believes the earnings environment may require a different perspective. “We’re seeing greater dispersion in earnings, with a notable differentiation between winners from losers. The key is whether there’s enough earnings growth to go around to keep the market moving ahead.” Haworth notes that investors should not be overly focused on current earnings. “Investors need to consider not just what companies won and lost this quarter, but what it means for their prospects going forward.”

If the economy continues to grow, Haworth believes it may expand the universe of stocks benefiting from that growth. “In recent times, technology-oriented stocks dominated market performance, but we think we’re seeing some broadening in the market today.” As a result, the U.S. Bank Asset Management Group advises investors to consider an equal weight S&P 500 index fund as part of their diversified equity portfolio. In such a portfolio, all S&P 500 index stocks are weighted equally. By contrast, the benchmark S&P 500 Index is market-capitalization weighted. That means the largest stocks carry the greatest weight. Haworth believes investors may have better potential by avoiding a large position in technology names that dominate the top of the market and carry high valuations following their recent strong run.

As you assess your investment options and how to best position your portfolio, it can be helpful to do so in the context of a financial plan. Talk with your wealth professional to review whether changes to your investment strategy may be warranted to better reflect your goals, risk appetite and time horizon.