The geopolitical climate continues to be marred by hotspots in eastern Europe and the Middle East. The ground war begun by Russia in 2022 intent on capturing Ukrainian territory continues, with Ukraine supported by most NATO countries. At the same time, Israel continues its war with Hamas, primarily centered in Gaza. There appear to be no immediate prospects for a quick end to either conflict.

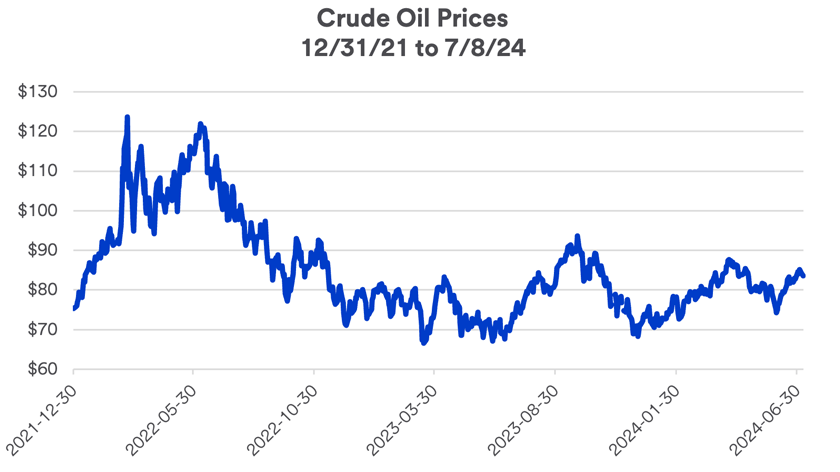

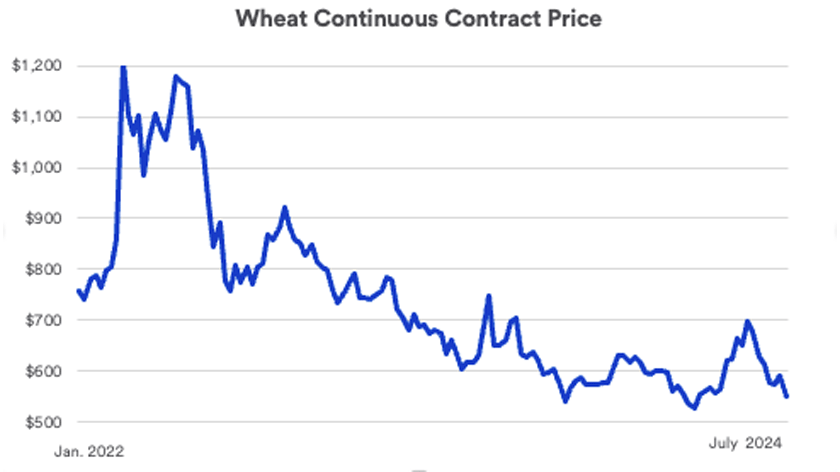

Along with the tragic human toll resulting from both conflicts, there are other costs that are closely monitored. Each conflict appeared to create temporary issues in commodities markets, but they generally haven’t persisted. However, the wars have the potential to serve as an external event that could distract investors from more fundamental factors such as economic developments and earnings trends.

Geopolitical events like the Russia-Ukraine and Israel-Hamas conflicts force government policymakers, central bankers and corporate leaders to contend with unique variables on a scale not experienced in decades. Nevertheless, investors appear to remain more focused on factors such as central bank policies, the interest rate environment, economic growth and corporate earnings. Is it possible that current geopolitical conflicts could eventually cause issues for the economy and capital markets as well?

A new phase of the Russia-Ukraine conflict?

Although it appeared Russia made some advances in the spring, the situation seems to have returned to a stalemate in recent months. Supported by U.S. and European equipment and financial backing, Ukraine managed to bolster its efforts to defend territory. Nevertheless, Russia continues to inflict great damage with air strikes on cities and on Ukraine’s power supply. Nevertheless, neither side seems to be close to achieving its objectives. “Russia is struggling against the backdrop of a supreme leader [Putin] who is bound and determined in his objective of taking military control over Ukraine,” says David Bridges, senior geopolitical and security advisor at Fidelity Management and Research Company. Bridges, who was a former operations officer at the CIA, including significant time in the former Soviet Union and Eastern Europe, says Putin may have deceived himself about the level of effort that was required to potentially claim a victory in Ukraine. Yet Putin has remained persistent in maintaining military pressure despite significant casualties that have accumulated over the war’s first two years.

In late 2023 and early 2024, additional U.S. funding ran into Congressional roadblocks. However, in April 2024, a breakthrough occurred, and Congress approved a $61 billion aid package to support Ukraine’s military efforts. In addition, NATO allies have recently voiced strong support for Ukraine. However, future U.S. support for Ukraine may hinge on the outcome of the election, as some prominent Republicans have questioned continued funding for Ukraine.

Expanding conflict in the Middle East?

The Israel-Hamas conflict is the latest in a long series of Middle East military encounters that occur frequently. The situation intensified following an October 2023 attack on Israeli territory by Hamas. Israel responded with its own invasion of the Gaza Strip, using ground troops and massive aerial bombardment. In response, Houthi rebels have attacked commercial and military ships in the Red Sea, a major navigation waterway leading to the Suez Canal. This disrupted shipping activity, particularly affecting the movement of oil supplies. The war’s potential to expand by involving another Israeli enemy, Hezbollah, based in the border country of Lebanon, could complicate matters. That prospect raises concerns that the Middle East situation could become more widespread, which might ultimately have more global economic ramifications. The April funding package for Ukraine also directed funding to Israel and humanitarian aid for residents of the Gaza Strip.

Geopolitical implications

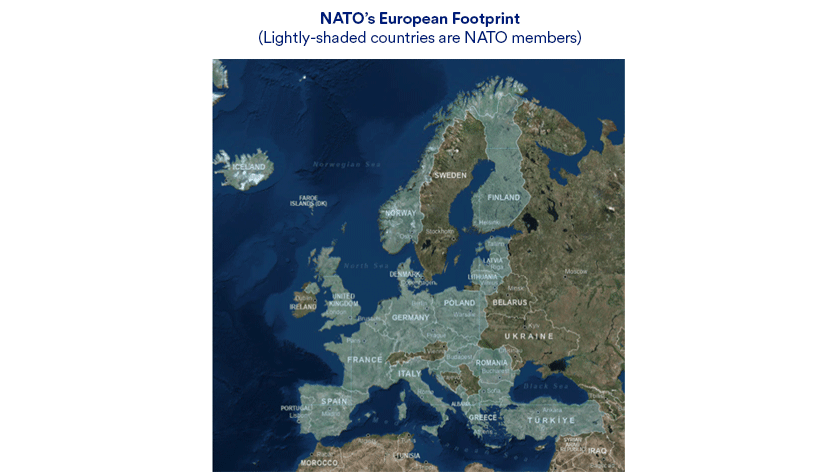

One result of Russia’s aggressive stance toward Ukraine is an expansion of NATO membership. Finland, which shares an 830-mile border with Russia, was accepted as part of the alliance in 2023. Sweden was added in 2024.