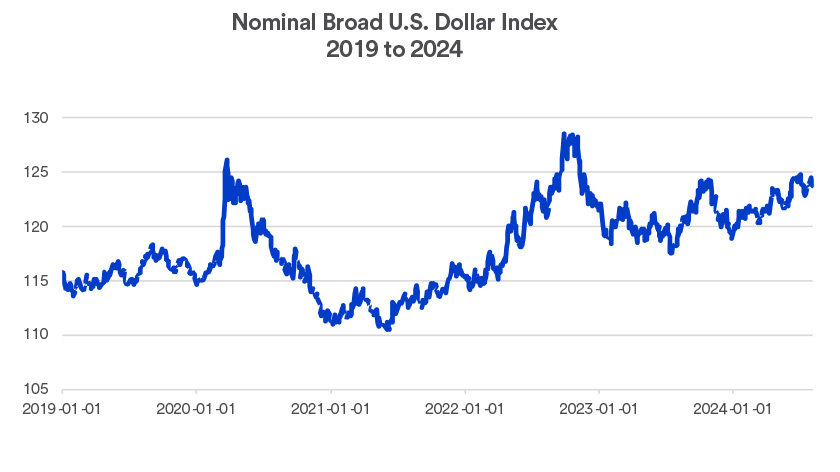

It should be noted that currencies fluctuate constantly. Changes are typically minor on a day-to-day basis, but trends may develop with potentially significant implications over time.

Economic impact of currency fluctuations

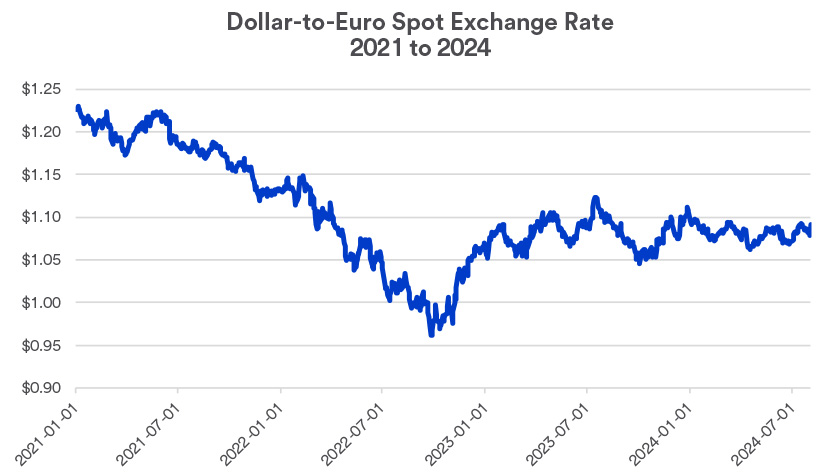

A positive feature of a stronger dollar is the lower cost of imported products from other countries. For example, if a car made in Germany is valued at €50,000 and then is imported to the U.S. when the dollar stands at $1.20 to €1, the retail price of the car in the U.S. would (theoretically) be $60,000 (20% more than its European price to reflect the currency exchange rate). If the dollar were to appreciate to $0.90 to €1, the car’s value in the U.S., using the same assumptions, would decline to $45,000, a significant savings for a U.S. consumer.

However, a strong dollar can also detract from revenues generated by multinational companies based in the U.S. The net income earned from foreign sales will decrease once exchanged into dollars. A stronger dollar means U.S. companies that export products abroad will be less competitive because the price of the product translated into euros or another currency is higher, which can lead to lower sales as foreign buyers shift to lower cost alternatives. The impact on the bottom line for companies trading overseas may be limited, however. “They have tools to adjust currency risk, such as locating production facilities in countries where they do business, or using currency hedging strategies to offset any unfavorable currency movements,” says Haworth.

Investment implications of dollar trends

Haworth says the impact of currency movements shouldn’t be a major consideration for investors as they assess the value of specific stocks. The same is not true, however, for U.S. investors who include overseas-based investments in their portfolios.

For example, consider the value of an investment in the MSCI European Union (EU) Index. Year-to-date through August 7, 2024, the index, in local currency terms, generated a return of 4.84%. However, the net return for a U.S.-based investor in the index, translated back into dollars, was just 3.54%.3 In other words, the stronger dollar resulted in a lower net return for a U.S investor in overseas markets. By contrast, when the dollar weakens compared to the euro, it enhances the net return for U.S. investors after the currency exchange.

“Currencies are less volatile than stocks as a whole, and their direction is challenging to predict, given numerous factors that influence relative currency values,” says Haworth. “Equity investors, in particular, should be somewhat insensitive to short-term dollar trends when positioning long-term investment assets.”

Future value of the dollar

Haworth says it’s not only relative interest rate policies that may give the dollar an edge in the short term. “The U.S. economy is stronger today than those of most developed countries across the globe. This can also influence currency markets and boost the dollar.” He also notes that the decline in the number of foreign buyers of U.S. Treasury securities may mean dollar fluctuations have less impact on Treasury market activity. “If we assume a growing percentage of Treasury investors are U.S. based, currency valuations become less of an issue,” says Haworth.

While currency considerations may not play a decisive role in your investment strategy, the issue could be worth discussing with your wealth management professional, particularly if your portfolio includes overseas investments. It can be beneficial to account for the ways currency trends might impact your investments and potentially influence how you choose to allocate assets within your portfolio in support of your investing strategy.