Key takeaways

Consumer spending, a key driver of the U.S. economy, has so far acted as a bulwark against recessionary pressures.

However, the total amount of household debt accumulated by Americans is at record levels.

Nevertheless, consumers still appear to be on solid ground financially – for now.

Consumer spending is considered the most important component of economic growth. The ability of U.S. consumers to maintain reasonable spending levels helped keep the U.S. economy moving in a modestly positive direction over the past year, despite the challenges created by the emergence of higher inflation and rising interest rates. In the 1st quarter of 2023, personal consumption expenditures represented more than 68% of the nation’s Gross Domestic Product.1 Much of that spending requires financing, particularly for bigger ticket items like homes, automobiles and higher education. In addition, many consumers take on debt when they use credit cards for day-to-day purchases but may not pay off the total bill each month.

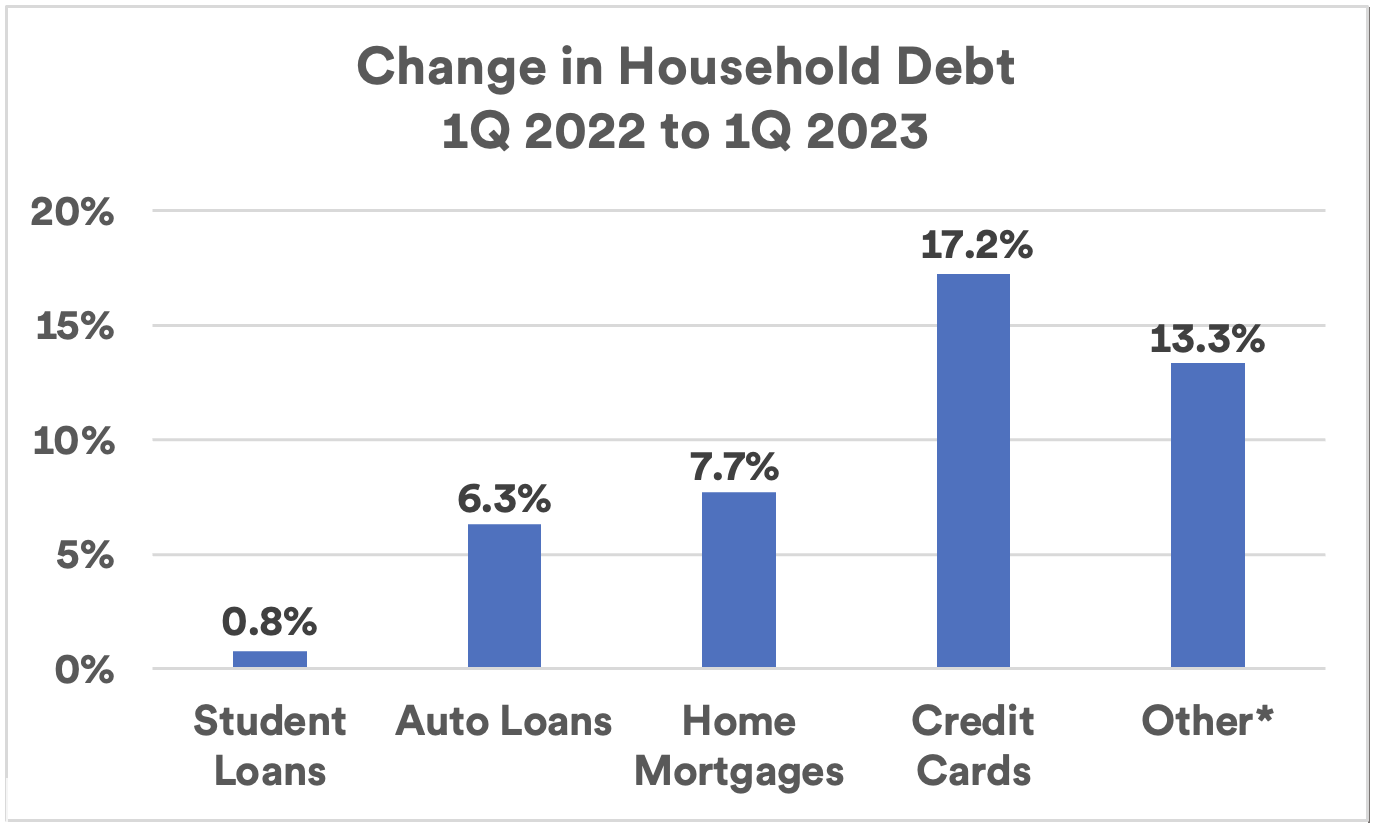

The role consumers play in driving economic activity, and their contribution to a growing economy, is one reason why investors pay close attention to the state of consumer debt. After the first quarter of 2023, total household debt in the U.S. reached a record high, totaling $17.05 trillion. This represents a 7.6% increase over the amount of debt held as of March 31, 2022.2

The upward trend in consumer debt contrasts with flatter growth in debt levels in 2020 and 2021. Household savings rates, defined as the proportion of unspent current income, moved higher dating back to the start of the COVID-19 pandemic in early 2020. Americans benefited from fiscal stimulus measures including student loan payment holidays and direct government payments to individuals, such as payments from the American Rescue Plan Act of 2021. At the same time, widespread business shutdowns limited consumer spending options.

As the economy reopened and more spending opportunities emerged (restaurants reopening, travel again being an option), many Americans spent a larger proportion of their income, dipped into accumulated savings and increasingly relied on credit to cover expenses. As a result, savings rates have declined in recent months. Is there a risk that if consumers take on too much debt, they’ll need to cut back on spending at some point, and if so, what would be the economic and investment ramifications?

Putting “record household debt” into perspective

Consumers started 2022 in a strong financial position, according to Rob Haworth, senior investment strategy director at U.S. Bank. “Consumer debt was low, savings were high and people were earning pay raises.” But Haworth says by the end of 2022, the environment changed. “We saw a meaningful rise in the amount of consumer borrowing, mostly in the form of unsecured revolving credit, like credit cards.” The trend continued in the opening months of 2023, as for example, total household credit card debt rose 17.2% for the one-year period ending March 31, 2023.2

Source: Federal Reserve Bank of New York, Center for Microeconomic Data, “Household Debt and Credit Report, 1st Quarter 2023.”

* Includes retail cards and other consumer loans.

The upward trend in consumer debt that began in 2022 contrasted with the two years leading up to that. “Household debt burdens declined during the pandemic,” says Matt Schoeppner, senior economist at U.S. Bank. “Consumers paid off credit card debt and other high interest loans.” However, Schoeppner notes that the economic environment began to change, with a resurgence of high inflation being the most marked difference from the pre-pandemic era and the early days of the pandemic. “As inflation became a burden and government payments ended, consumers were willing to take on more debt.”

“If people are borrowing more money, the question is whether they are in a position to pay it back.”

Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management

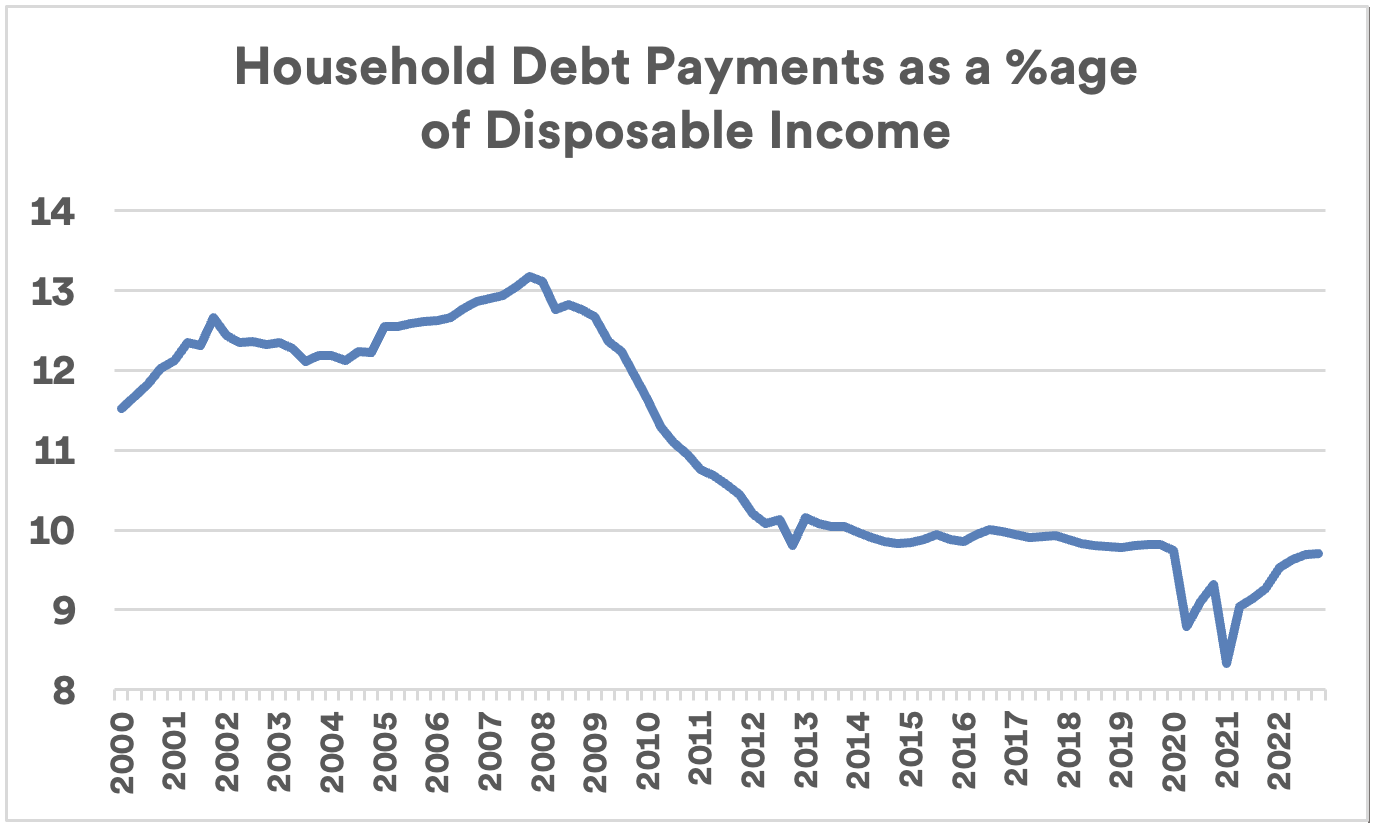

While the raw data about rising amounts of household debt can be concerning, Haworth notes that some perspective is required. “If people are borrowing more money, the question is whether they are in a position to pay it back,” says Haworth. “Consumers today appear to be protecting their balance sheets. They aren’t on a borrowing spree, but borrowing up to a point where it makes sense for them.” As shown in the chart below, through the fourth quarter of 2022, household debt service payments represented, on average, less than 10% of disposable personal income. While higher than the recent low point of 8.3% in early 2021, it is far below recent peak levels in 2007 and 2008, when debt amounted to more than 13% of disposable income.3

Source: Board of Governors of the Federal Reserve System (US).

Consumers keep the economy on track

Consumers’ willingness to maintain spending levels even though economic growth slowed in 2022 proved to be important at a time when many anticipated the potential onset of a recession. With the Federal Reserve tightening monetary policy (raising the short term federal funds interest rate, reducing its balance sheet of Treasury and mortgage-backed securities), the stage was set for a possible recession. To this point, consumers have played a major role in keeping one from occurring.

“The willingness of consumers to take on debt provided a bridge of support during this period of economic uncertainty,” says Schoeppner. “Taking on more credit is ultimately a game of faith. It signals that lenders have enough confidence in the economy that they believe consumers will remain in a strong position to make timely repayments.”

Consumers have likely been buoyed by the strong jobs market. The nation’s unemployment rate is at historically low levels, new job growth has been solid, and wages have risen at a faster rate than in recent times. Haworth believes consumers remain in a good position to maintain moderate spending growth and manage their increasing debt loads. “Even though the rate of wage growth has leveled off in recent months, the same is true with inflation, so consumers don’t appear to be at risk of falling behind based on recent trends.”

Haworth also believes that most recent indicators point to a continuation of favorable job market trends. “Small businesses appear to still be looking to hire. You would think if they anticipated an economic slowdown, that wouldn’t be the case.”

Manageable consumer debt levels

Haworth notes that consumer attitudes toward debt have changed significantly since the financial crisis of 2007-2009. At that time, consumer debt levels reached new highs, with some households maintaining multiple mortgages and building up balances on more than one credit card. “Consumers are more cautious about debt today,” says Haworth. “They’re looking to spend but are being more vigilant to avoid going overboard.”

Schoeppner agrees that the rising consumer debt levels do not yet set off any economic warning signals. “Non-mortgage debt is back to pre-pandemic levels relative to income, but not yet anything of concern. Mortgage debt is still reasonable by recent standards, even with the spike in mortgage rates.”

The jobs market is likely to dictate consumer spending habits. “For now, the labor market remains robust,” says Haworth. “A key number to watch is initial weekly jobless claims.” That number rose to 264,000 in early May 2023, its highest reading since October 2021. For most of the time since, initial weekly jobless claims were in the low 200,000s.4 “It will become more concerning if initial weekly jobless claims consistently rise above 300,000,” says Haworth.

Does consumers’ willingness to continue spending work against the Federal Reserve’s effort to lower inflation? “The Fed is trying to find a level of borrowing costs that is sufficiently restrictive to slow things down enough to bring inflation back down to its target level of approximately 2%,” says Schoeppner.

While the market’s sentiment is that the Fed may be, for this cycle, close to or finished with hiking its federal funds rate, Haworth says the impact on the mortgage market is uncertain. “Mortgage rates are closely tied to the yield on 10-year U.S. Treasury notes,” says Haworth. “10-year Treasury note yields remain below 4%, while the fed funds rate is over 5%. We would expect 10-year yields to exceed those of the fed funds rate over time, so depending on what happens in the market, mortgage rates, tracking with the 10-year Treasury yield, might go higher.” That raises questions about the impact on housing demand and its economic ramifications.

Keeping an eye on debt

Consumer debt trends will bear scrutiny in the months to come. Based on current data, consumers don’t appear to be spending beyond their means. Could that change in the future? Haworth is watching two key indicators:

- The volume of revolving credit relative to disposable personal income. As noted above, that figure remains relatively low based on the most recent data. “If it starts to rise, it could trigger more concerns about the potential that consumers will ultimately need to pull back on spending,” says Haworth. That could contribute to recession fears.

- The state of the job market. “If there are signs of weakening, that could indicate consumers will be forced to rein in spending or carry considerably more credit to maintain current spending levels,” says Haworth.

Schoeppner adds that sentiment about the direction of the economy could be a major consideration. “If consumers, businesses and financial institutions all begin to lose faith about the direction of the economy at the same time, that could tighten credit availability, which would have negative economic ramifications.” Schoeppner emphasizes that this environment does not exist today, primarily because of the labor market’s continuing strength.

Given the critical role consumer spending plays in the broader economy, any slowdown in spending activity could raise recession risks. Investors will want to keep an eye on how consumer activity, including the need to take on more credit, might impact the economy moving forward.

It’s important to consider the current economic outlook as you evaluate your own portfolio of investments. Talk to your wealth planning professional to assess how your portfolio is best positioned, keeping in mind current market dynamics and your long-term financial goals.

Tags:

Related articles

The effect of the job market on the economy

Set against the backdrop of a slowing economy, the strong job market has drawn the attention of the Federal Reserve as it adjusts monetary policy to help curb inflation.

Is the economy at risk of a recession?

The Federal Reserve is focused on fighting inflation with aggressive policy moves intended to slow consumer demand. Does this put the economy at risk of a recession in 2023?