What is a home equity line of credit (HELOC) and what can it be used for?

Preparing for retirement: 8 steps to take

Multiple accounts can make it easier to follow a monthly budget

Estate planning documents: Living trusts vs. will vs. living will

Why estate planning is important

How a Health Savings Account (HSA) can benefit your retirement plan

How to manage your money: 7 tips to improve your finances

Year-end financial checklist

Housing market trends and relocation impact

Finance or operating lease? Deciphering the legalese of equipment finance

Buying or leasing? Questions to ask before signing a contract

Insource or outsource? 10 considerations

The secret to successful service provider integration

Maximizing your deductions: Section 179 and Bonus Depreciation

How to improve your business network security

Safeguarding the payment experience through contactless

COVID-19 safety recommendations: Are you ready to reopen?

Unexpected cost savings may be hiding in your payment strategy

Changes in credit reporting and what it means for homebuyers

High-cost housing and down payment options in relocation

Crypto + Relo: Mobility industry impacts

For today's relocating home buyers, time and money are everything

How to sell your business without emotions getting in the way

5 steps to take before transitioning your business

10 tips on how to run a successful family business

Talent acquisition 101: Building a small business dream team

Make your business legit

How I did it: Turned my side hustle into a full-time job

Costs to consider when starting a business

How to test new business ideas

How to get started creating your business plan

How to establish your business credit score

The costs of hiring a new employee

How to expand your business: Does a new location make sense?

The essential business tips for tax deductions

How to build a content team

12 ways to reduce your taxable income

Multigenerational household financial planning strategies

LGBTQ+ financial planning tips

Key components of a financial plan

Do I need a financial advisor?

5 financial goals for the new year

How to track expenses

How to manage your finances when you're self-employed

Good debt vs. bad debt: Know the difference

Good money habits: 6 common money mistakes to avoid

Reviewing your beneficiaries: A 5-step guide

Estate planning checklist: 8 steps to secure your legacy

How to talk about money with your family

Financial steps to take after the death of a spouse

6 tips for trust fund distribution to beneficiaries

How to build wealth at any age

Retirement plan options for the self-employed

Retirement advice: How to retire happy

Key milestone ages as you near and start retirement

Retirement income planning: 4 steps to take

Retirement savings by age

Preparing for retirement: 8 steps to take

Comparing term vs. permanent life insurance

How much life insurance do I need?

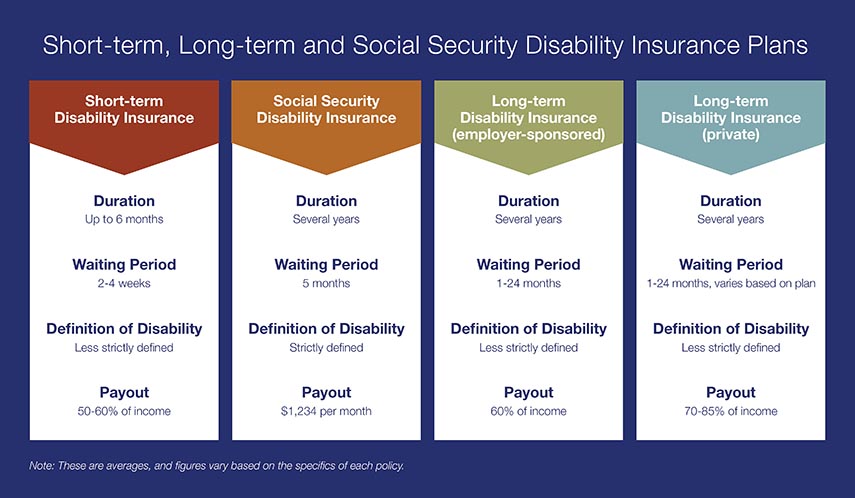

Is your employer long term disability insurance enough?

8 steps to choosing a health insurance plan

What is Medicare? Understanding your coverage options

7 things to know about long-term care insurance

How I did it: Switched career paths by taking an unexpected pivot

Transitioning from the military to the civilian workforce

Achieving their dreams through a pre-apprenticeship construction program

Working after retirement: Factors to consider

4 steps to finding a charity to support

How to be prepared for tax season as a gig worker

Tips and tools for tax season and beyond

Year end tax planning tips

Should I itemize my taxes?

A guide to tax diversification in investing

Do your investments match your financial goals?

Investment strategies by age

How to Adult: 7 tax terms and concepts you should know

How to Adult: 5 ways to track your spending

Tips for navigating a medical hardship when you’re unable to work

11 essential things to do before baby comes

Webinar: Uncover the cost: Starting a family

Preparing for adoption and IVF

How to plan and save for adoption and in vitro fertility treatment costs

Checklist: 10 questions to ask your home inspector

Closing on a house checklist for buyers

Resources for managing financial matters after an unexpected death

What you need to know as the executor of an estate

What documents do you need after a loved one dies?

Checklist: financial recovery after a natural disaster

How does money influence your planning?

College budgeting: When to save and splurge

How to save money in college: easy ways to spend less

How to gain financial independence from your parents

The A to Z’s of college loan terms

Co-signing 101: Applying for a loan with co-borrower

Practical money skills and financial tips for college students

How to build credit as a student

5 things to know before accepting a first job offer

How I did it: Paid off student loans

Bank Notes: College cost comparison

Tips to earn that A+ in back-to-school savings

Outsmart tax scams and keep your finances safe

Annual insurance review checklist

From LLC to S-corp: Choosing a small business entity

Recognize. React. Report. Caregivers can help protect against financial exploitation

Webinar: U.S. Bank asks: Are you safe from fraud?

Is online banking safe?

How you can prevent identity theft

What to do with your tax refund or bonus

Loud budgeting explained: Amplify your money talk

How to financially prepare for pet costs

Pros and cons of a personal line credit

3 tips for saving money when moving to a new home

5 ways to maximize your garage sale profits

Tips for handling rising costs from an Operation HOPE Financial Wellbeing coach

Is raising backyard chickens a good idea financially?

3 ways to keep costs down at the grocery store (and make meal planning fun)

5 tips for creating (and sticking to) a holiday budget

Should you buy now, pay later?

Financial checklist: Preparing for military deployment

Planning self-care moments that matter (and how to finance them)

Friction: How it can help achieve money goals

5 things to consider when deciding to take an unplanned trip

Stay committed to your goals by creating positive habits

How I kicked my online shopping habit and got my spending under control

Growing your savings by going on a ‘money hunt’

Working with an accountability partner can help you reach your goals

Why a mobile banking app is a ‘must have’ for your next vacation

How to decide when to shop local and when to shop online

How I did it: Learned to budget as a single mom

Your 5-step guide to financial planning

Webinar: Common budget mistakes (and how to avoid them)

Does your savings plan match your lifestyle?

Uncover the cost: Wedding

Uncover the cost: International trip

What military service taught me about money management

Are savings bonds still a thing?

Tips to overcome three common savings hurdles

Adulting 101: How to make a budget plan

Helpful tips for safe and smart charitable giving

Personal loans first-timer's guide: 7 questions to ask

3 awkward situations Zelle can help avoid

Allowance basics for parents and kids

Mindset Matters: How to practice mindful spending

How to save money while helping the environment

How can I help my student manage money?

How to manage money in the military: A veteran weighs in

You can take these 18 budgeting tips straight to the bank

Save time and money with automatic bill pay

How to best handle unexpected expenses

Common unexpected expenses and three ways to pay for them

Stay on budget — and on the go — with a mobile banking app

Which is better: Combining bank accounts before marriage — or after?

Do you and your fiancé have compatible financial goals?

U.S. Bank asks: Transitioning out of college life? What’s next?

U.S. Bank asks: Do you know your finances?

U.S. Bank asks: Do you know what an overdraft is?

Personal finance for teens can empower your child

Is it time to get a shared bank account with your partner?

It's possible: 7 tips for breaking the spending cycle

How to save for a wedding

Here’s how to create a budget for yourself

Don’t underestimate the importance of balancing your checking account

9 simple ways to save

7 steps to prepare for the high cost of child care

Tips for working in the gig economy

Dear Money Mentor: How do I set and track financial goals?

5 reasons why couples may have separate bank accounts

Lost job finance tips: What to do when you lose your job

Money Moments: 3 smart financial strategies when caring for aging parents

Tips to raise financially healthy kids at every age

Money management guide to financial independence

Money Moments: 8 dos and don’ts for saving money in your 30s

7 financial questions to consider when changing jobs

30-day adulting challenge: Financial wellness tasks to complete in a month

Travel for less: Smart (not cheap) ways to spend less on your next trip

Money Moments: How to manage your finances after a divorce

What’s in your emergency fund?

Certificates of deposit: How they work to grow your money

What you need to know about renting

How to stop living paycheck to paycheck post-pay increase

Practical money tips we've learned from our dads

What I learned from my mom about money

Understanding guardianship and power of attorney in banking

How to increase your savings

Bank from home with these digital features

What financial advice would you give your younger self?

How grandparents can contribute to college funds instead of buying gifts

How to open and invest in a 529 plan

Using 529 plans for K-12 tuition

Parent checklist: Preparing for college

What to consider before taking out a student loan

Consolidating debts: Pros and cons to keep in mind

How to talk to your lender about debt

How to use debt to build wealth

7 steps to keep your personal and business finances separate

Know your debt-to-income ratio

Overcoming high interest rates: Getting your homeownership goals back on track

For today's homebuyers, time and money are everything

Crypto + Homebuying: Impacts on the real estate market

Should you buy a house that’s still under construction?

How I did it: Bought my dream home using equity

Buying a home Q&A: What made three homeowners fall in love with their new home

House Hacks: How buying an investment property worked as my first home

Managing the impacts of appraisal gaps in a hot housing market

How I did it: Built living spaces to support my family

Spring cleaning checklist for your home: 5 budget-boosting tasks

Saving for a down payment: Where should I keep my money?

Your guide to breaking the rental cycle

Checklist: 6 to-dos for after a move

What are conforming loan limits and why are they increasing

Military homeownership: Your guide to resources, financing and more

Uncover the cost: Building a home

How I did it: Bought a home without a 20 percent down payment

The lowdown on 6 myths about buying a home

Home buying myths: Realities of owning a home

4 ways to free up your budget (and your life) with a smaller home

Get more home for your money with these tips

Money Moments: Tips for selling your home

Money Moments: How to finance a home addition

How I did it: My house remodel

Are professional movers worth the cost?

Dear Money Mentor: When should I refinance a mortgage?

Beyond the mortgage: Other costs for homeowners

Building a dream home that fits your life

10 ways to increase your home’s curb appeal

10 questions to ask when hiring a contractor

5 things to avoid that can devalue your home

What is an escrow account? Do I have one?

Is it the right time to refinance your mortgage?

What to know when buying a home with your significant other

These small home improvement projects offer big returns on investment

Should you get a home equity loan or a home equity line of credit?

Mortgage basics: How much house can you afford?

Mortgage basics: Finding the right home loan for you

Is a home equity line of credit (HELOC) right for you?

How to use your home equity to finance home improvements

How do I prequalify for a mortgage?

Home equity: Small ways to improve the value of your home

Can you take advantage of the dead equity in your home?

8 steps to take before you buy a home

6 questions to ask before buying a new home

10 uses for a home equity loan

Improving your credit score: Truth and myths revealed

Credit: Do you understand it?

U.S. Bank asks: What do you know about credit?

Car shopping: Buying versus leasing your next vehicle

Take the stress out of buying your teen a car

How to winterize your vehicle

Questions to ask before buying a car