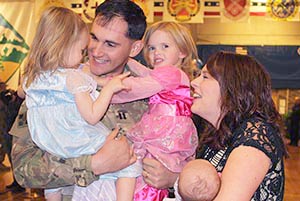

Preparing your family’s finances ahead of military deployment can bring everyone more peace of mind while you’re away.

If you’re an active-duty military member, the possibility of being deployed to another part of the world for weeks or months at a time is always present. Being away from family for long periods of time can be emotionally taxing but setting yourself up for financial success while away can help reduce stress around bill paying, budgeting, taxes and more. Keep this list of military deployment financial to-dos on hand so you can ensure you and your family are prepared for a deployment.

Pre-deployment legal work

Being deployed means you won’t always be reachable. Act before deploying to protect you and your family in case of an unexpected event.

Review the Servicemembers Civil Relief Act (SCRA)

Deployed military personnel can face new or unexpected expenses while they’re deployed. The SCRA provides government assistance to individuals and families by way of reducing interest rates on debt, providing the ability to break a lease, delaying foreclosures and more. To initiate SCRA you will need to contact your lender, landlord or service provider with written record of relevant information; read up on the SCRA to find out what protections are available to you.

Arrange legal protections

Before your military deployment, you should obtain specific powers of attorney to cover financial items and any other issues you may need to have addressed while away. Power of attorney lets a spouse, trusted friend or family member handle legal, financial and health-related matters in the event you’re unable to advocate for yourself. Military personnel can set up power of attorney for a specific set of time or circumstances by filling out a form provided by your branch of the military.

You should also create or update your will. A living will can help your family and friends act according to your wishes if anything happens to you. If a long time has passed since your last deployment or you’ve had a life change, consider revisiting your will before you leave to ensure everything is up to date.

Prepare insurance policies

Life insurance is an important tool that can help take care of your family if anything happens to you. Servicemembers’ Group Life Insurance is available to active-duty military personnel and other eligible military members for a low cost, with guaranteed coverage of $400,000.

You’ll also want to let your car insurance company know if your car will be idle or in storage. Depending on your provider and plan, this can decrease your monthly payment while you’re deployed.

Gather all important documents in one place

Make sure all your important insurance and financial documents are in one safe place before you leave. Go over each item with your partner or power of attorney grantee so they know how you’d like things taken care of.

Financial security during military deployment

Life keeps moving, even when you’re away. From paying bills on time to keeping your identity protected, take these steps to prepare yourself for deployment.

Arrangements for bill-paying during deployment

Make a list of all your bills, their due dates, account numbers and any user login credentials. Set up automatic bill pay for all bills if you can. Make sure any monthly bills that come out of your account are automated, especially if you’ll have limited access to Wi-Fi in the region you’re deployed, otherwise you will need to entrust someone to make those payments if you are unavailable to do so yourself. It’s also a good idea to set up mobile banking; download your bank’s app and connect your accounts, so you can review purchases and deposits from anywhere.

Protect your finances during military deployment

If you have a family, merging finances with your partner can make it easier for them to maintain a budget while you’re gone. Set up a joint account with your spouse, or if you’ve granted them power of attorney, you can give them access to your account.

Military personnel are 76% more likely than other American adults to report identity theft. Contact one of the three major credit reporting bureaus — TransUnion, Experian or Equifax — and ask to have an active-duty alert put on your credit report. This will require any businesses attempting to issue a line of credit or loan in your name to take extra steps to verify your identity.

Deployment budget goals

Being deployed means a difference in your financial landscape; here are ways to navigate it and even save money along the way during your military deployment.

Update your budget

It’s likely that your family’s budget will change while you’re away — and so will your military compensation. Depending on where and how long you’re deployed, you may see your military pay increase. The Family Separation Allowance provides military families with an additional $250 a month if you’re away for more than 30 days or your family won’t be traveling with you. Account for any additional funds and expenses your family will have — think childcare, moving costs, etc.

Make a savings plan

Even during military deployment, you can still pursue your financial goals. Decide ahead of time how you want to continue any savings plans while you’re gone. The U.S. Bank Mobile App offers automatic savings deposits that transfer money from your checking to savings account according to a time-bound goal you set within the app. Military members also have access to the Savings Deposit Program, a military program that allows deployed servicemembers to invest up to $10,000 that guarantees 10% annual interest compounded quarterly.

Create an emergency fund

Before your military deployment, it’s important to have money set aside for any emergencies your family might have to take care of while you’re away. Set aside enough money to cover at least three months’ worth of expenses for your household.

We’re committed to helping military members and their families reach their financial goals. Learn more about military benefits available through U.S. Bank.