Changes in credit reporting and what it means for homebuyers

How I did it: Turned my side hustle into a full-time job

Tips for realtors to help clients get their homeownership goals back on track

Checklist: 10 questions to ask your home inspector

Closing on a house checklist for buyers

Pros and cons of a personal line credit

3 tips for saving money when moving to a new home

Know your debt-to-income ratio

Checklist: 10 things to look for when touring a home

Overcoming high interest rates: Getting your homeownership goals back on track

Is it cheaper to build or buy a house

For today's homebuyers, time and money are everything

Crypto + Homebuying: Impacts on the real estate market

Should you buy a house that’s still under construction?

How I did it: Bought my dream home using equity

Buying a home Q&A: What made three homeowners fall in love with their new home

How I did it: Built living spaces to support my family

Bringing economic opportunity to underserved communities one home at a time

Community activist achieves dream of homeownership

Saving for a down payment: Where should I keep my money?

Your guide to breaking the rental cycle

Checklist: 6 to-dos for after a move

What are conforming loan limits and why are they increasing

Military homeownership: Your guide to resources, financing and more

Uncover the cost: Building a home

How I did it: Bought a home without a 20 percent down payment

The lowdown on 6 myths about buying a home

Home buying myths: Realities of owning a home

4 ways to free up your budget (and your life) with a smaller home

Get more home for your money with these tips

Are professional movers worth the cost?

First-time homebuyer’s guide to getting a mortgage

How you can take advantage of low mortgage rates

What to know when buying a home with your significant other

Mortgage basics: Prequalification or pre-approval – What do I need?

Mortgage basics: How much house can you afford?

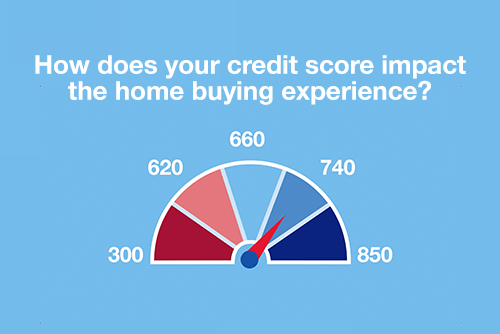

Mortgage basics: How does your credit score impact the homebuying experience?

Mortgage basics: Finding the right home loan for you

Mortgage basics: Buying or renting – What’s right for you?

Mortgage basics: 3 key steps in the homebuying process

How do I prequalify for a mortgage?

8 steps to take before you buy a home