What is a home equity line of credit (HELOC) and what can it be used for?

Year-end financial checklist

How liquid asset secured financing helps with cash flow

Hybridization driving demand

An investor’s guide to marketplace lending

What is a CLO?

Beyond Mars, AeroVironment’s earthly expansion fueled by U.S. Bank

ABL mythbusters: The truth about asset-based lending

What type of loan is right for your business?

Collateral options for ABL: What’s eligible, what’s not?

Can ABL options fuel your business — and keep it running?

Maximizing your infrastructure finance project with a full suite trustee and agent

How to improve your business network security

Evaluating interest rate risk creating risk management strategy

Tech lifecycle refresh: A tale of two philosophies

Changes in credit reporting and what it means for homebuyers

4 benefits of independent loan agents

At your service: outsourcing loan agency work

Middle-market direct lending: Obstacles and opportunities

5 steps to take before transitioning your business

Streamline operations with all-in-one small business financial support

How to fund your business without using 401(k) savings

How I did it: Turned my side hustle into a full-time job

Costs to consider when starting a business

How to test new business ideas

How to get started creating your business plan

How to establish your business credit score

How to expand your business: Does a new location make sense?

4 small business trends that could change the way you work

Common small business banking questions, answered

3 signs it’s time for your business to switch banks

How jumbo loans can help home buyers and your builder business

When to consider switching banks for your business

5 tips to help you land a small business loan

Does your side business need a separate bank account?

Leverage credit wisely to plug business cash flow gaps

How to establish your business credit score

5 financial goals for the new year

How to manage your finances when you're self-employed

Good debt vs. bad debt: Know the difference

Reviewing your beneficiaries: A 5-step guide

How to talk about money with your family

Retirement plan options for the self-employed

Key milestone ages as you near and start retirement

Comparing term vs. permanent life insurance

How much life insurance do I need?

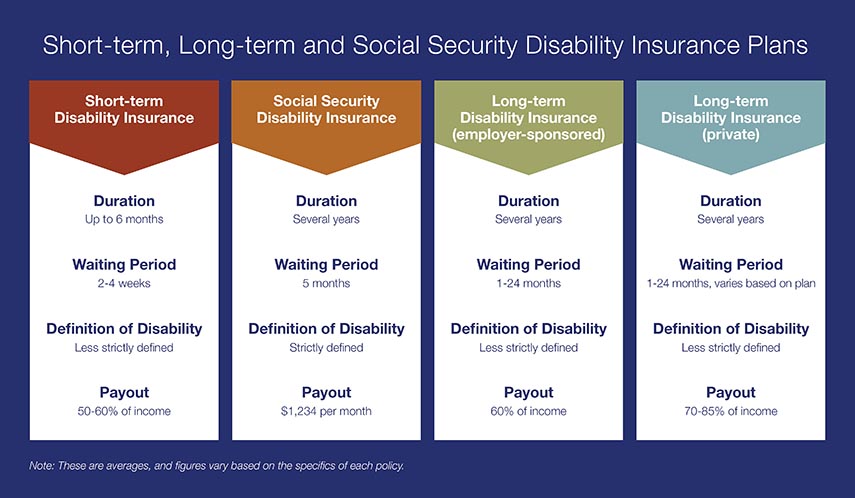

Is your employer long term disability insurance enough?

8 steps to choosing a health insurance plan

What is Medicare? Understanding your coverage options

7 things to know about long-term care insurance

How to be prepared for tax season as a gig worker

Student checklist: Preparing for college

The A to Z’s of college loan terms

Co-signing 101: Applying for a loan with co-borrower

Practical money skills and financial tips for college students

How to build credit as a student

How I did it: Paid off student loans

Recognize. React. Report. Caregivers can help protect against financial exploitation

Webinar: U.S. Bank asks: Are you safe from fraud?

How you can prevent identity theft

How to financially prepare for pet costs

Planning self-care moments that matter (and how to finance them)

Booming in the gig economy: A new chapter leveraging 45 years of experience

Adulting 101: How to make a budget plan

Personal loans first-timer's guide: 7 questions to ask

What’s your financial IQ? Game-night edition

Common unexpected expenses and three ways to pay for them

Stay on budget — and on the go — with a mobile banking app

Here’s how to create a budget for yourself

7 steps to prepare for the high cost of child care

A passion for fashion: How this student works the gig economy

Earning in the gig economy: Gladys shares her story

By the numbers: The gig economy

Tips for working in the gig economy

Money Moments: 3 smart financial strategies when caring for aging parents

5 tips to use your credit card wisely and steer clear of debt

What’s in your emergency fund?

Understanding guardianship and power of attorney in banking

Your financial aid guide: What are your options?

Is a home equity loan for college the right choice for your student

Parent checklist: Preparing for college

How to apply for federal student aid through the FAFSA

What to consider before taking out a student loan

Are you ready to restart your federal student loan payments?

Everything you need to know about consolidating debts

5 tips to use your credit card wisely and steer clear of debt

5 steps to selecting your first credit card

How to use debt to build wealth

What’s a subordination agreement, and why does it matter?

Understanding the true cost of borrowing: What is amortization, and why does it matter?

Know your debt-to-income ratio

How to use credit cards wisely for a vacation budget

Your quick guide to loans and obtaining credit

Dear Money Mentor: How do I begin paying off credit card debt?

Dear Money Mentor: What is cash-out refinancing and is it right for you?

Overcoming high interest rates: Getting your homeownership goals back on track

What are conforming loan limits and why are they increasing

Money Moments: How to finance a home addition

How I did it: My house remodel

Is it the right time to refinance your mortgage?

What to know when buying a home with your significant other

These small home improvement projects offer big returns on investment

Should you get a home equity loan or a home equity line of credit?

Mortgage basics: How does your credit score impact the homebuying experience?

Is a home equity line of credit (HELOC) right for you?

How to use your home equity to finance home improvements

How do I prequalify for a mortgage?

Can you take advantage of the dead equity in your home?

8 steps to take before you buy a home

6 questions to ask before buying a new home

4 questions to ask before you buy an investment property

10 uses for a home equity loan

How to request a credit limit increase

Improving your credit score: Truth and myths revealed

6 essential credit report terms to know

5 unique ways to take your credit card benefits further

Myth vs. truth: What affects your credit score?

Test your loan savvy

Decoding credit: Understanding the 5 C’s

Credit: Do you understand it?

How to build and maintain a solid credit history and score

Should you give your child a college credit card?

U.S. Bank asks: What do you know about credit?

What types of credit scores qualify for a mortgage?

What is a good credit score?

How to improve your credit score

Take the stress out of buying your teen a car

Questions to ask before buying a car

What you should know about buying a car

How to choose the best car loan for you