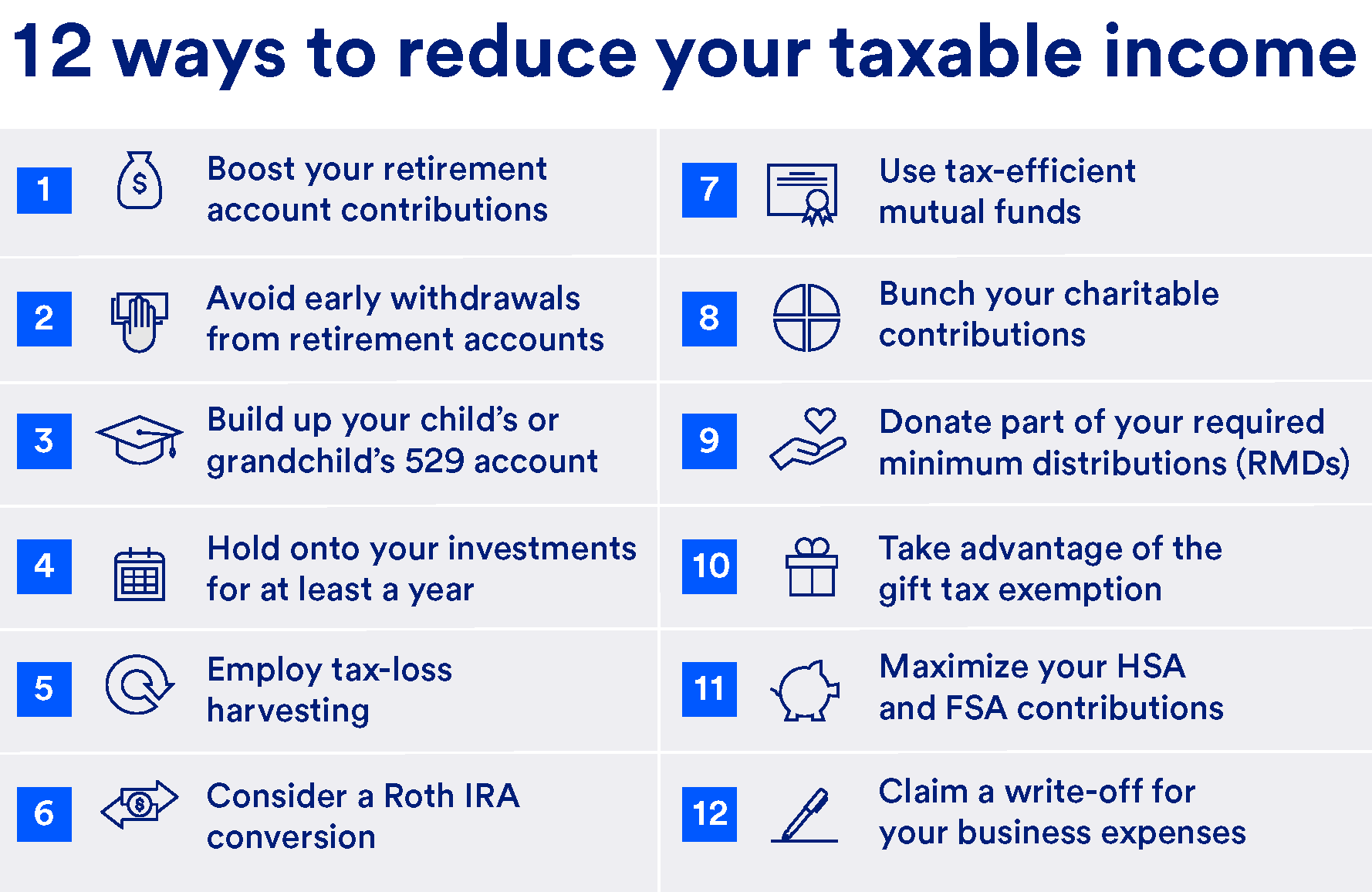

Reduce taxable income tip 1: Boost your retirement account contributions

Making pre-tax contributions to a traditional 401(k) or 403(b), up to the annual limit, is one of the easiest ways to reduce your taxable income while building your nest egg. In 2024, the contribution maximum is $23,000, or $30,500 if you’re 50 or older.

If you already maxed out the employer match on your workplace plan (or are planning to), diverting some of your money to an individual retirement account (IRA) may allow you to benefit from a wider range of investment choices. Depending on your income level and whether you’re covered by a retirement plan at work, you may be able to deduct some or all of that investment on your tax return.

A convenient way to open an IRA is with a robo-advisor. You’ll get a portfolio mix based on your goals, timeline and risk tolerance. If your asset mix changes based on market activity, the automated investing platform will automatically rebalance your investments to get you back to your target allocation.