Managing your finances in the military

Multiple accounts can make it easier to follow a monthly budget

Does your side business need a separate bank account?

LGBTQ+ financial planning tips

How I did it: Transitioned from the military to a private sector career

Should I itemize my taxes?

How to Adult: 7 tax terms and concepts you should know

How to Adult: 5 ways to track your spending

Webinar: Uncover the cost: Starting a family

How to plan and save for adoption and in vitro fertility treatment costs

What you need to know as the executor of an estate

When your spouse has passed away: A three-month financial checklist

What documents do you need after a loved one dies?

How does money influence your planning?

College budgeting: When to save and splurge

6 questions students should ask about checking accounts

Four ways to make a strong resume for your first real job

Helping Gen Z build financial confidence

Short- and Long-Term Financial Goals for Every Life Stage

How your taxes can change after a major life event

Get back on track with your New Year’s financial resolutions

What to do with your tax refund or bonus

Live your money values in 2024

Loud budgeting explained: Amplify your money talk

How to set financial goals you will keep

Financial goals for 2024 a 12-month planning guide

How to save for a dream vacation

Tips for talking about money when friends earn more

How new parents can prepare for the costs of a new child

How to save more money in 2024

Building confidence in your finances and career

How to financially prepare for pet costs

Pros and cons of a personal line credit

3 tips for saving money when moving to a new home

5 ways to maximize your garage sale profits

Tips for handling rising costs from an Operation HOPE Financial Wellbeing coach

What is a Certificate of Deposit? And what to know before opening an account

What does FDIC mean?

Is raising backyard chickens a good idea financially?

3 financial tools to help automate your finances

5 things to deinfluence in your finances

3 ways to keep costs down at the grocery store (and make meal planning fun)

5 tips for creating (and sticking to) a holiday budget

Make holiday gift giving easier in a digital world

Should you buy now, pay later?

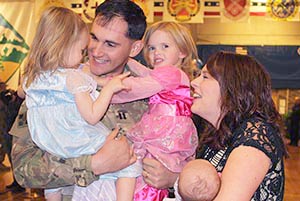

Financial checklist: Preparing for military deployment

How to financially prepare for a military PCS

Planning self-care moments that matter (and how to finance them)

Friction: How it can help achieve money goals

5 things to consider when deciding to take an unplanned trip

Stay committed to your goals by creating positive habits

An eco friendly debit card with roots in Haiti

How I kicked my online shopping habit and got my spending under control

Growing your savings by going on a ‘money hunt’

Working with an accountability partner can help you reach your goals

The banking app you need as a new parent

Why a mobile banking app is a ‘must have’ for your next vacation

How to decide when to shop local and when to shop online

A who’s who at your local bank

Webinar: 5 myths about emergency funds

How I did it: Learned to budget as a single mom

Your guide to starting a job: Resources to help along the way

Your 5-step guide to financial planning

5 myths about emergency funds

Webinar: Common budget mistakes (and how to avoid them)

Does your savings plan match your lifestyle?

Mobile banking tips for smarter and safer online banking

Uncover the cost: Wedding

Uncover the cost: International trip

What military service taught me about money management

Are savings bonds still a thing?

Tips to overcome three common savings hurdles

Booming in the gig economy: A new chapter leveraging 45 years of experience

Adulting 101: How to make a budget plan

How having savings gives you peace of mind

Helpful tips for safe and smart charitable giving

Personal loans first-timer's guide: 7 questions to ask

3 awkward situations Zelle can help avoid

Allowance basics for parents and kids

What’s your financial IQ? Game-night edition

Mindset Matters: How to practice mindful spending

How and when to ask for a raise

How to save money while helping the environment

How can I help my student manage money?

Steer clear of overdrafts to your checking account

How to manage money in the military: A veteran weighs in

Things to know about the Servicemembers Civil Relief Act

You can take these 18 budgeting tips straight to the bank

3 tips for saving money easily

Save time and money with automatic bill pay

How to best handle unexpected expenses

Common unexpected expenses and three ways to pay for them

Stay on budget — and on the go — with a mobile banking app

Which is better: Combining bank accounts before marriage — or after?

Do you and your fiancé have compatible financial goals?

U.S. Bank asks: Transitioning out of college life? What’s next?

U.S. Bank asks: Do you know your finances?

U.S. Bank asks: Do you know what an overdraft is?

Personal finance for teens can empower your child

Is it time to get a shared bank account with your partner?

It's possible: 7 tips for breaking the spending cycle

How to save for a wedding

Here’s how to create a budget for yourself

Don’t underestimate the importance of balancing your checking account

9 simple ways to save

7 steps to prepare for the high cost of child care

A passion for fashion: How this student works the gig economy

Earning in the gig economy: Gladys shares her story

By the numbers: The gig economy

Tips for working in the gig economy

How compound interest works

Dear Money Mentor: How do I set and track financial goals?

5 tips for parents opening a bank account for kids

5 reasons why couples may have separate bank accounts

Checking and savings smarts: Make your accounts work harder for you

Lost job finance tips: What to do when you lose your job

Money Moments: 3 smart financial strategies when caring for aging parents

Tips to raise financially healthy kids at every age

Money management guide to financial independence

First-timer’s guide to savings account alternatives

Money Moments: 8 dos and don’ts for saving money in your 30s

7 financial questions to consider when changing jobs

Tips and resources to help in the aftermath of a natural disaster

Myths vs. facts about savings account interest rates

30-day adulting challenge: Financial wellness tasks to complete in a month

5 tips to use your credit card wisely and steer clear of debt

Travel for less: Smart (not cheap) ways to spend less on your next trip

Money Moments: How to manage your finances after a divorce

Money Moments: 3 tips for planning an extended leave of absence

Overdrafts happen: Steps to get you back on track

What’s in your emergency fund?

Certificates of deposit: How they work to grow your money

P2P payments make it easier to split the tab

Essential financial resources and protections for military families

What you need to know about renting

Dear Money Mentor: How do I pick a savings or checking account?

Real world advice: How parents are teaching their kids about money

How to stop living paycheck to paycheck post-pay increase

Practical money tips we've learned from our dads

6 ways to spring clean your finances and save money year-round

What I learned from my mom about money

How to cut mindless spending: real tips from real people

Understanding guardianship and power of attorney in banking

How to increase your savings

Bank from home with these digital features

What financial advice would you give your younger self?

Military finance: How to create a family budget after military service

Managing money as a military spouse during deployment

How I saved $10,000 in just one year

Discovering your money personality can help you save

Tips on how couples can learn to agree about money

How to sell and buy a home at the same time

Overcoming high interest rates: Getting your homeownership goals back on track

First-time homebuyer’s guide to getting a mortgage

How to request a credit limit increase

What applying for store credit card on impulse could mean