Preparing for retirement: 8 steps to take

Multiple accounts can make it easier to follow a monthly budget

How a Health Savings Account (HSA) can benefit your retirement plan

Year-end financial checklist

Hospitals face cybersecurity risks in surprising new ways

How to improve your business network security

Meeting healthcare strategy goals with electronic patient refunds

Standardizing healthcare payments

Consolidating payments for healthcare systems

3 benefits of integrated payments in healthcare

Top 3 ways digital payments can transform the patient experience

Automating healthcare revenue cycle

5 steps to take before transitioning your business

Make your business legit

Costs to consider when starting a business

How to test new business ideas

How to expand your business: Does a new location make sense?

6 common financial mistakes made by dentists (and how to avoid them)

How to choose the right business savings account

Does your side business need a separate bank account?

Key components of a financial plan

5 financial goals for the new year

Good money habits: 6 common money mistakes to avoid

7 beneficiary designation mistakes to avoid

Reviewing your beneficiaries: A 5-step guide

How to talk about money with your family

Financial steps to take after the death of a spouse

Retirement quiz: How ready are you?

How to build wealth at any age

Retirement plan options for the self-employed

IRA vs. 401(k): What's the difference?

Retirement advice: How to retire happy

Social Security benefits questions and answers

Key milestone ages as you near and start retirement

Retirement income planning: 4 steps to take

Retirement savings by age

Preparing for retirement: 8 steps to take

Comparing term vs. permanent life insurance

Healthcare costs in retirement: Are you prepared?

How much life insurance do I need?

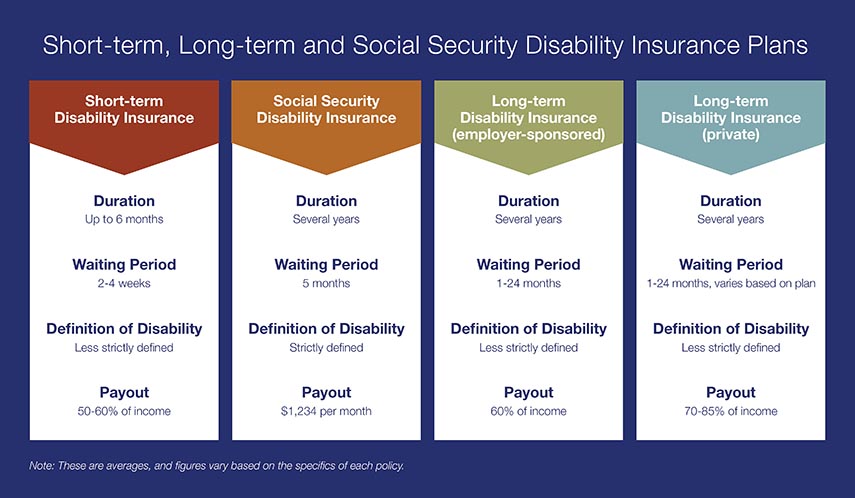

Is your employer long term disability insurance enough?

8 steps to choosing a health insurance plan

What is Medicare? Understanding your coverage options

7 things to know about long-term care insurance

Working after retirement: Factors to consider

A guide to tax diversification in investing

What Is a 401(k)?

Saving vs. investing: What's the difference?

Do your investments match your financial goals?

How to Adult: 5 ways to track your spending

Tips for navigating a medical hardship when you’re unable to work

3 steps to prepare for a medical emergency

How to plan and save for adoption and in vitro fertility treatment costs

Resources for managing financial matters after an unexpected death

What documents do you need after a loved one dies?

Rebuilding finances after a natural disaster

How to save money in college: easy ways to spend less

How to gain financial independence from your parents

5 things to know before accepting a first job offer

Annual insurance review checklist

Recognize. React. Report. Caregivers can help protect against financial exploitation

Webinar: U.S. Bank asks: Are you safe from fraud?

How you can prevent identity theft

What to do with your tax refund or bonus

How to financially prepare for pet costs

5 ways to maximize your garage sale profits

3 financial tools to help automate your finances

Planning self-care moments that matter (and how to finance them)

5 things to consider when deciding to take an unplanned trip

Growing your savings by going on a ‘money hunt’

Working with an accountability partner can help you reach your goals

How to decide when to shop local and when to shop online

Webinar: 5 myths about emergency funds

How I did it: Learned to budget as a single mom

Your 5-step guide to financial planning

5 myths about emergency funds

Does your savings plan match your lifestyle?

Uncover the cost: Wedding

Uncover the cost: International trip

What military service taught me about money management

Are savings bonds still a thing?

Tips to overcome three common savings hurdles

Adulting 101: How to make a budget plan

How having savings gives you peace of mind

Helpful tips for safe and smart charitable giving

Allowance basics for parents and kids

Mindset Matters: How to practice mindful spending

How to manage money in the military: A veteran weighs in

You can take these 18 budgeting tips straight to the bank

3 tips for saving money easily

How to best handle unexpected expenses

Common unexpected expenses and three ways to pay for them

Which is better: Combining bank accounts before marriage — or after?

Do you and your fiancé have compatible financial goals?

It's possible: 7 tips for breaking the spending cycle

How to save for a wedding

Here’s how to create a budget for yourself

9 simple ways to save

7 steps to prepare for the high cost of child care

Tips for working in the gig economy

How compound interest works

5 tips for parents opening a bank account for kids

Checking and savings smarts: Make your accounts work harder for you

Money Moments: 3 smart financial strategies when caring for aging parents

Tips to raise financially healthy kids at every age

Money management guide to financial independence

First-timer’s guide to savings account alternatives

Money Moments: 8 dos and don’ts for saving money in your 30s

7 financial questions to consider when changing jobs

Myths vs. facts about savings account interest rates

Travel for less: Smart (not cheap) ways to spend less on your next trip

What’s in your emergency fund?

Certificates of deposit: How they work to grow your money

Dear Money Mentor: How do I pick a savings or checking account?

Practical money tips we've learned from our dads

6 ways to spring clean your finances and save money year-round

What I learned from my mom about money

How to cut mindless spending: real tips from real people

Understanding guardianship and power of attorney in banking

How to increase your savings

Bank from home with these digital features

What financial advice would you give your younger self?

Saving for a down payment: Where should I keep my money?

How I did it: Bought a home without a 20 percent down payment

The lowdown on 6 myths about buying a home

Home buying myths: Realities of owning a home

Beyond the mortgage: Other costs for homeowners