Key takeaways

Inflation has dropped recently but is still a factor, so it’s important to make sure your investments keep pace with living costs.

Treasury Inflation-Protected Securities, or TIPS, are fixed-income securities that provide inflation protection. TIPS premiums increase when the Consumer Price Index rises and decrease when the CPI falls.

It’s important to understand the risks and consult with a financial professional before investing in TIPS bonds.

Like most investors, you probably have fixed-income investments in your portfolio. But with inflation still a concern, how can you position those assets so the higher cost of living won’t ding your returns? Treasury Inflation-Protected Securities, often called TIPS bonds, could be one solution.

Inflation’s effect on investment portfolios

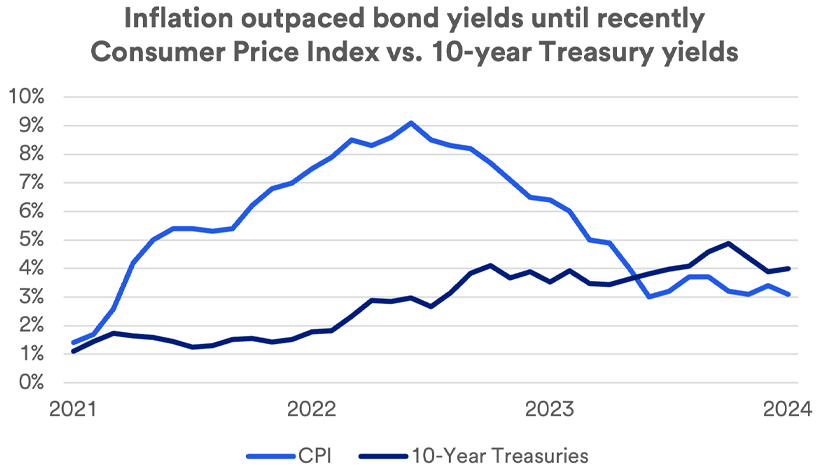

Let’s take a minute to look at inflation in recent years. The cost of living, as measured by the Consumer Price Index (CPI), started to rise in 2021 and peaked in mid-2022. During that period, inflation far outpaced typical 10-year U.S. Treasury bond yields.

The CPI has since come down and is now below 10-year bond yields, but it’s still about two percentage points higher than it was before it started to climb.

TIPS bonds are one way to protect your portfolio from inflation. TIPS are issued by the U.S. government and, like other Treasury securities, are backed by the full faith and credit of the federal government. Unlike regular bonds, however, TIPS provide the potential to earn a total return that reflects inflation.

“TIPS tend to perform best in periods when the interest rate environment is relatively stable but inflation is suddenly moving higher.”

Rob Haworth, senior investment strategy director for U.S. Bank Wealth Management

For a long-term investor, TIPS can offer an opportunity for an investment that keeps pace with living costs,” says Rob Haworth, senior investment strategy director for U.S. Bank Wealth Management.

How do TIPS bonds work?

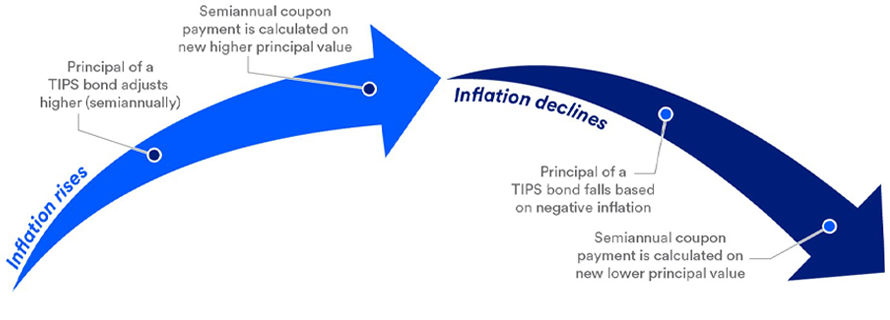

TIPS bonds account for inflation by adjusting the principal value of the security in line with the inflation rate. When the CPI rises, the principal value of a TIPS bond also rises. If deflation occurs and the CPI drops, the principal value of TIPS drops, too.

SOURCE: U.S. Bank Asset Management Group. For illustrative purposes only and not based on specific historical outcomes.

As an example, say you own a TIPS bond valued at $10,000 with a coupon of 2%. Based on the initial principal value of $10,000, you would see income of $200 for the year.

Now let’s look at what would happen in the case of inflation or deflation:

- Inflation: If the CPI increases by 3%, the principal adjusts by the same percentage ($10,300). You receive 2% of $10,300 for the year, or $206.

- Deflation: If the CPI declines 4%, the $10,000 principal on your TIPS bond readjusts to $9,600, and the 2% coupon gives a return of $192.

Note that the coupon rate (2%, in this example) remains constant whatever the CPI is doing.

How do interest rates affect TIPS bonds?

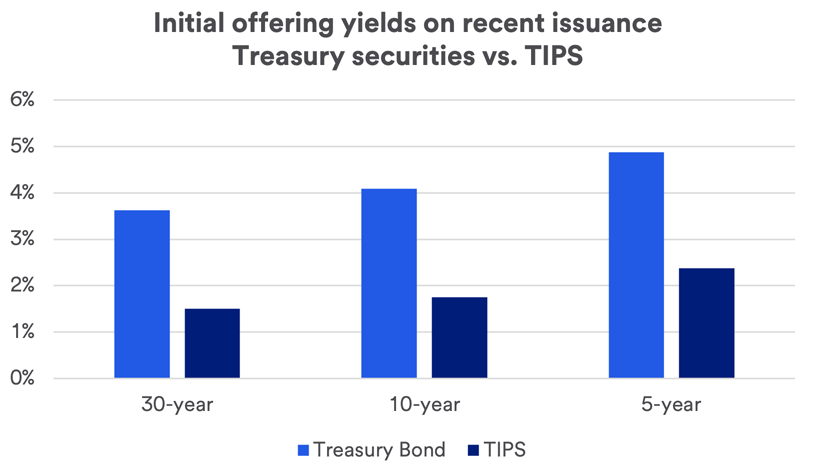

First, you should be aware that TIPS typically pay a lower yield than comparable Treasury securities. In essence, you trade off current yield for inflation protection.

In terms of the interest rate’s impact, Haworth notes that just as with other Treasury securities, TIPS are at a disadvantage when rates rise.

“When interest rates are rising, prices of TIPS are subject to a loss in value just as is the case with other types of bonds,” he says. “The impact of inflation is still reflected in the price of TIPS, but they’re also subject to changes in the broader interest rate environment.”

Opportunities and risks with TIPS

As you think about how TIPS might fit into your portfolio, it can be helpful to weigh the opportunities they provide along with the risks.

Opportunities:

- TIPS allow bond investors to achieve a degree of inflation protection not available in most other fixed-income investments.

- TIPS are backed by the full faith and credit of the U.S. government, meaning they have low credit risk.

- Both underlying principal and the income it generates can rise in line with the rate of inflation.

- At maturity, the principal value of TIPS will be no lower than your initial investment.

Risks:

- As with traditional bonds, the underlying value of TIPS can decline in times when interest rates are rising.

- In deflationary times, the value of TIPS and income generated from them will decline.

- Any appreciation in principal value is taxable even before you realize those gains.

These are also good talking points when meeting with a financial professional.

TIPS bonds FAQ

Here are some frequently asked questions about TIPS that you should consider before investing in them.

How do I buy TIPS bonds?

TIPS are issued at various times throughout the year and are sold in $100 increments. You can purchase TIPS through the U.S. Treasury website with maturities at auction of 5, 10 or 30 years. You can also purchase bonds with interim maturities through a bank or brokerage firm, or directly online. Certain mutual funds and exchange traded funds (ETFs) may also invest in TIPS.

When is a good time to buy TIPS bonds?

“TIPS tend to perform best in periods when the interest rate environment is relatively stable but inflation is suddenly moving higher,” says Haworth. “In periods like these, the inflation adjustments in TIPS can provide some advantages.”

What is the outlook for TIPS in 2024?

While inflation is still considered elevated (consistently in the 3.0% to 3.5% range since mid-2023), U.S. Bank doesn’t anticipate that it will reverse course and move significantly higher in the near term. “We would need to see something change, or an event such as a crisis that would result in supply constraints,” says Haworth. “The tight labor market remains an inflation risk as well, should wage gains accelerate from current levels.”

How often do TIPS pay interest?

TIPS pay interest every six months until the bond’s maturity. The rate of interest is fixed and based on the underlying principal value. Since the principal value can change, the interest can change as well.

Are TIPS bonds taxed?

Interest payments from TIPS are subject to federal tax but are exempt from state and local taxes. In addition, if the principal value increases, the amount of that increase is taxable at the federal level in the year it occurs. This is true even if you don’t realize any gains — an effect called “phantom income.”

When do I receive the TIPS bond principle?

The inflation-adjusted principal value isn’t realized until the bond issue matures or you sell it. At that point, you would receive the adjusted principal value or the original principal value, whichever is higher.

Can I lose money on a TIPS bond?

You will never receive less from a TIPS bond than the original amount you paid for it.

How is inflation measured for TIPS bonds?

TIPS Inflation Index Ratios1 are provided by the U.S. Treasury Department to help calculate the impact on bonds.

Do TIPS always provide inflation protection?

Since TIPS typically pay an interest rate that is lower than that offered by a comparable Treasury security, investors may not benefit from inflation protection if cost-of-living changes are minimal over the holding period.

Seek professional advice before investing in TIPS bonds

Before buying TIPS bonds, you should assess current inflation expectations or consider the degree of inflation protection you need in your fixed-income portfolio. A financial professional can help you determine if TIPS are a good fit for your investment portfolio.

Learn how we approach investment management.

Based on our strategic approach to creating diversified portfolios, guidelines are in place concerning the construction of portfolios and how investments should be allocated to specific asset classes based on client goals, objectives and tolerance for risk. Not all recommended asset classes will be suitable for every portfolio. Diversification and asset allocation do not guarantee returns or protect against losses.

Indexes mentioned are unmanaged and are not available for investment.

Tags:

Related articles

How to invest in bonds for portfolio diversification

Bonds are a common investment in times of economic uncertainty, but they also play an important role in diversifying your portfolio.

Financial planning considerations when inflation is high and interest rates are rising

Persistent inflation and rising interest rates affect your ability to meet your financial goals. Consider these strategies to help mitigate risk and boost potential returns.