American society is changing, and so are its families. These changes create new financial challenges and opportunities.

Today’s families come in many forms. All want to build a secure financial future – one that meets their needs today and their goals for tomorrow.

We can help you work toward that secure future. Our Private Wealth Advisors work with modern families like yours to assess where you’re at now, decide where you’re going and then create a smart financial plan to get you there. We’ll be alongside you – with the tools you need to succeed and answers to your questions – every step of the way.

SPECIALIZED WEALTH STRATEGIES

Caring for the needs of modern families

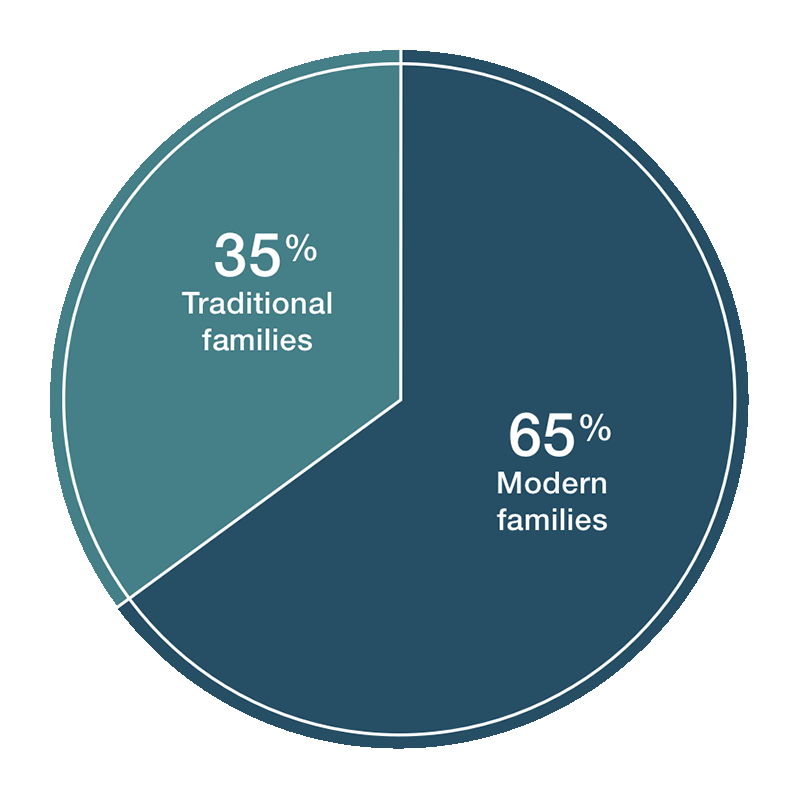

Modern families make up two-thirds of all families in the U.S. today.1 These families include:

- Divorced and remarried couples, often with blended families

- LGBTQ+ families

- Multigenerational families sharing a home

- Single parents with children

Our Private Wealth Management team tailors our strategic financial planning to meet the unique needs of each family situation.

Modern families

Blended families

Blended families represent the widest range and largest number of U.S. family households. In remarriages, 65% include children from previous relationships.2

Managing competing financial priorities between children and stepchildren, and current and previous spouses, can be a challenge. We can assist you in planning for your entire family’s future.

LGBTQ+ families

There are important nuances to financial planning for LGBTQ+ individuals and families. Ongoing discrimination in credit, housing and employment heightens the importance of a solid financial plan to protect you and your loved ones.

We’ll work with you as you identify your priorities, which may include adoption or surrogacy, domestic partnership or marriage, a career change or retirement, to help you move toward your goals.

Multigenerational families

“Sandwich generation” describes families who balance the responsibilities of caring for their parents and children. Or, perhaps you’re a grandparent who has assumed responsibility for your grandchildren.

We can provide expertise to help you preserve your wealth while providing for all of those you love.

Single adult households

Approximately 27% of households are maintained by a single adult.3 If you’re part of this growing group, you know the importance of being financially self-reliant and planning ahead. You don’t have to go it alone. Together we can create a financial strategy to support your independent lifestyle.

Starting a family later in life

A growing segment of modern families includes those with at least one parent who’s 35 or older when their first child is born.

You’re more financially secure and looking for ways to protect your growing family. We can help you create a wealth plan that includes insurance and legacy considerations, so you’re prepared for what life brings.

Our services

Your vision, our expertise

With your goals in mind, your Private Wealth Advisor will design a custom financial plan that brings together the right mix of products and services to fit your needs. Select any of the following links to learn more about our services.

Insurance products are available through our affiliate U.S. Bancorp Investments.

Insights from our experts

Getting married again? 5 considerations before combining finances

If you’re getting married again and have children, discussing a few key financial topics before saying “I do” can help set you up for success.

Strategies for navigating family financial conversations

There’s no time like the present to address financial matters with your family. Here are three tips for a productive discussion.

Financial planning for the “sandwich generation”

Three tips on how to take care of your own finances while financially supporting others.