“Our U.S. Bank team combines the power of our hyper-local experience with our 155-plus year history of relationship banking in the U.S. to build solutions that grow commercial businesses.”

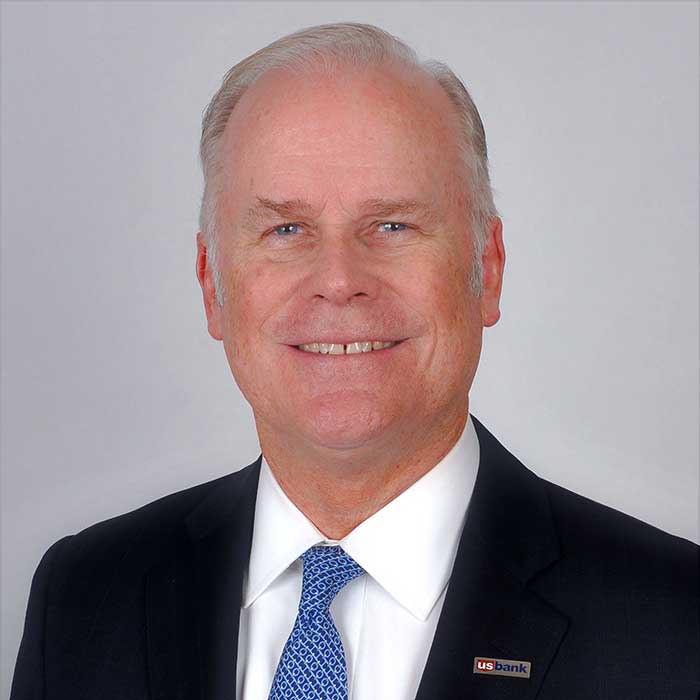

Daniel Greene,

Senior Vice President

We’re a part of the East Coast.

We invest in our local communities.*

- $71 million in community development loans and investments to low- and moderate-income communities.

- $5.3 million U.S. Bank Foundation and corporate giving

- 9,000 volunteer hours

We support Northeast business.*

- 12,000+ business customers

- $1.6 billion paid to partner-certified diverse suppliers

We live and work in the Northeast.*

- 596,000+ customers

- 1,688 employees

*Total customer, business customer data, branches and employee data as of December 31, 2021. Community investment data is three-year totals from January 1, 2019 – December 31,2021.

CFOs and senior finance leaders share their priorities.

We surveyed 2,030 finance leaders from all across the country to find out what they are focused on. The results reveal that they are seeking to balance defensive strategies with strategies for meaningful growth. Cost-cutting is top priority, and there are concerns about geopolitics and inflation.

The CFO Insights Report offers a deep dive into the survey results and provides helpful context that can empower you in your own leadership.

Invigorate your business with personalized financing.

Work with our relationship managers to make your financial operations more efficient and identify opportunities to accelerate goal progress with digital innovations.

Finance the technology and equipment you need tomorrow, today.

Make payments easy by sending them instantly, no card required.

Simplify business and travel expense management with a corporate card.

Insights to influence your business plans and goals

Pay foreign suppliers in their own currency.

Do you pay foreign suppliers in their local currency? When you think about whether there’s a way to improve how your organization pays for imports, there are four goals to consider.

A fresh POV on corporate credit card benefits.

Do you have employees paying for business expenses on a personal credit card? There’s an easier way. Read about the proven value of corporate cards to manage business transactions.

How improving customer visibility earned us recognition.

There’s pressure to make innovative banking technology accessible and actionable for all users. U.S. Bank was honored for achieving both of those goals with a pair of Model Bank awards.

Meet your commercial banking team.

You need a financial partner that understands corporate banking and commercial banking needs for your organization. Count on our commitment to build your trust and offer expert guidance along your business journey.

Daniel Greene

Senior Vice President

Office: 646-971-4903

Cell: 631-708-4349

Email: daniel.greene@usbank.com

Erica Manoff-Steinberg

Senior Vice President

Office: 646-935-4578

Cell: 646-531-8190

Email: erica.manoff@usbank.com

Esther Lainis

Senior Vice President

Office: 646-935-4503

Cell: 914-474-8666

Email: esther.lainis@usbank.com